A Crypto.com Review

CRYPTODAY 060

On the last Cryptoday, I wrote about how I was having trouble getting my Crypto.com debit card up and running. There were issues at almost every step: account opening, ID verification, customer support. (In fact, the only place where it seemed to work reliably was in the $CRO staking feature.) Now that I’ve been able to use the card, I can finally share my full review.

First, let’s talk about the concept of a crypto debit card. On the surface, there’s nothing “new” about the Crypto.com card. I got my first two crypto-backed debit cards all the way back in 2014, from Xapo and ANX, respectively. Both had the same experience: you needed to deposit your crypto into their custodial wallet app, then convert some of it into a fiat balance (usually USD) before it would be useable when you tried to buy something. Because nearly all of my money is in crypto, I can’t emphasize enough how useful cards like these are. They allow you to treat your fiat balance as your “spending budget” while keeping your crypto “savings” conveniently accessible right in the same app. Both Xapo and ANX were very early to the game, and both of them eventually had to discontinue those original cards. You have to remember that back then, crypto was considered a black-market asset, so a lot of the early debit cards were shut down due to a myriad of regulatory concerns.

But it’s 2021 now and crypto companies are buying stadiums. Crypto.com has been particularly aggressive: they hired Matt Damon as their main ambassador, leaning hard on his spacefaring acting career with their “Fortune Favors the Bold” campaign. Their debit card differs from the older concepts in two significant ways. First, if you want the card with better perks, they encourage you to buy some of their $CRO token and then lock it up for at least 6 months. Second, their perks are significant enough that this could arguably be the best international debit card open to Filipinos.

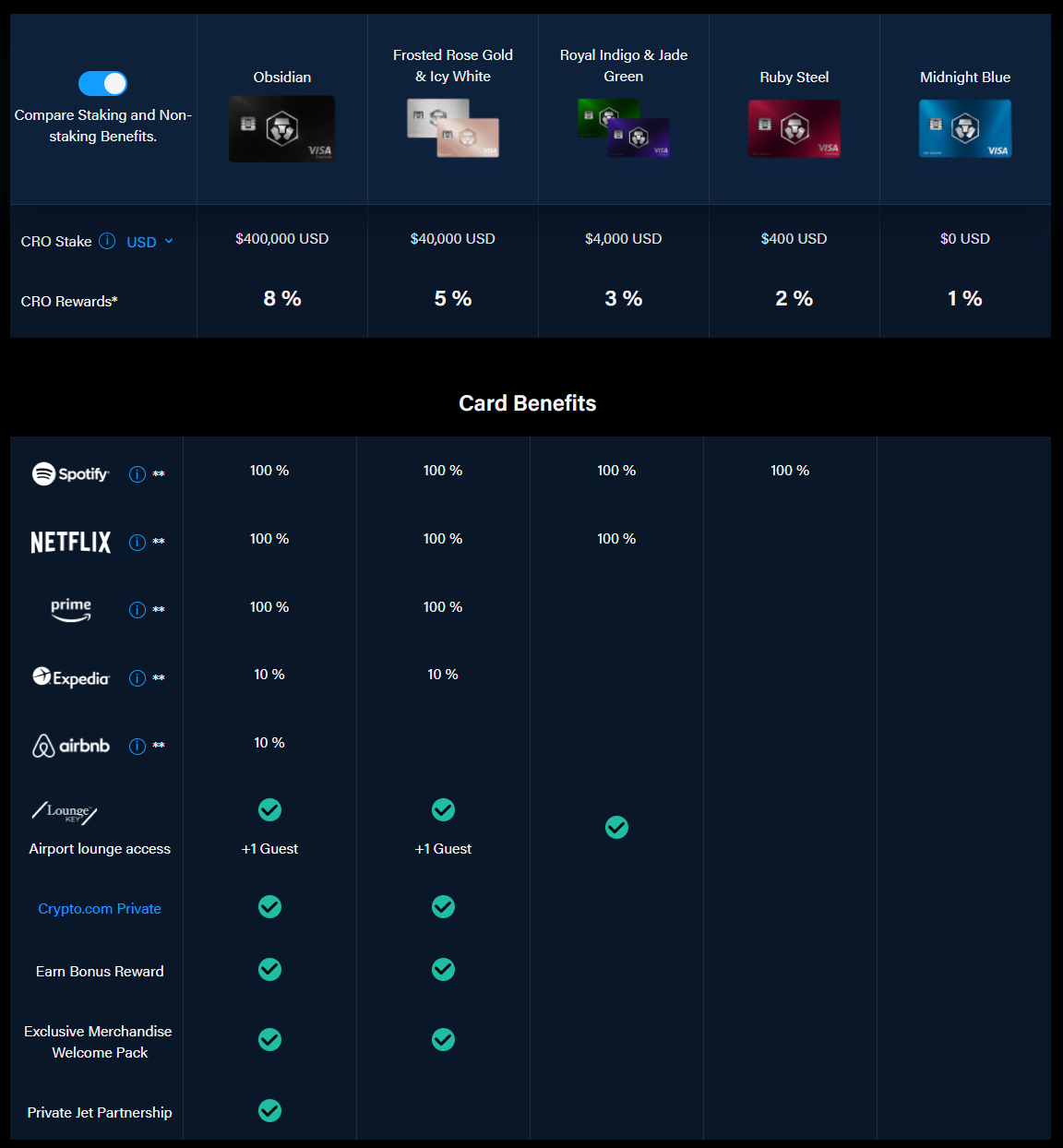

You can read through the various card offers at https://crypto.com/cards I’ll try to be specific as possible when I talk about my own experiences with Crypto.com, not because I’m trying to flex, but because it will help clarify why I like this card. In early October, I opted to stake $4,000 worth of $CRO so I could get the mid-tier Jade Green card. It’s a 6-month lock-up, so you have to think about this one pretty deeply before committing a lot of money to it. At the time, $CRO was $0.18. Once my stake was locked in, I went through the lengthy customer verification process to get my account upgraded for the debit card. After endless customer support discussions, I finally got my account fully verified and my debit card issued. The entire process took nearly 6 weeks, and I nearly gave up at multiple points. By the time I actually activated my debit card, $CRO was $0.40, so I had doubled my position purely by accident. Then they announced that they had bought the naming rights for Staples Center in the US, and $CRO began its bull run in earnest. As of this morning, $CRO is over $0.80, so I’ve unintentionally quadrupled my investment just because I wanted to experiment with a damn debit card.

Let’s walk through some of those perks because the gravy train doesn’t end there. The most substantial one is the $CRO Rewards, which is actually a real-time cashback. Every time you use the Green debit card, regardless of the amount, you instantly receive 3% cashback in CRO tokens. If you move up to the higher tier, the Gold or White cards, the cashback increases to 5%. And then of course, if you are willing to stake $400,000 in the Obsidian tier, it’s basically like you’re seeing 11/11 discounts every day of the year. Because the cashback reward is real-time you can convert it into stablecoins (or in my case $BTC during its recent dip) right within the app whenever you want. And then of course there’s other stuff: Netflix and Spotify basically become free services at the Green tier, and the higher tiers include Amazon Prime and a hefty Expedia discount for frequent travelers.

Now let’s talk about the downsides. The debit card seems to work reliably at all physical venues I’ve tried it at (various restaurants in BGC, the Samsung store in SM Aura, a random Petron gas station), but it is really inconsistent with online purchases. I’ve never been able to get it to work at the online Apple Store or Lazada, but it has worked when I booked a hotel room, and when I bought some royalty-free sound effects. I’m in a week-long customer support chat where I’m attempting to get to the bottom of all this, but so far the one thing I can say for sure is that it works with POS terminals at physical stores. Crypto.com is currently experiencing a very massive growth spike right now, so be warned that you will be waiting two to three times longer for your support concerns to be addressed. That being said, this is a damn fine debit card when it actually works.

Quick commentary on the recent market trends! Bitcoin has been slow to break through $60k after its dip last week, while the rest of the market has mostly rebounded. Supposedly, this is because of Mt Gox, a name that a lot of Bitcoin OGs will remember as the site of the industry’s first major folly. In 2014, the Mt Gox exchange collapsed after it was discovered that 850,000 BTC had been siphoned off from its treasury. Japanese courts have been attempting to disentangle the situation since the implosion, and finally this month, it appears that they are approving a plan to start repaying the customers who lost their Bitcoins all those years ago. That’s a lot of $BTC potentially flooding the market, from customers who have been hurting for the better part of eight years. The repayments appear to be scheduled for the first half of 2022, but it seems that the market is already trying to price in its potential impact.

Have a great weekend, cryptofam! See you all in December!