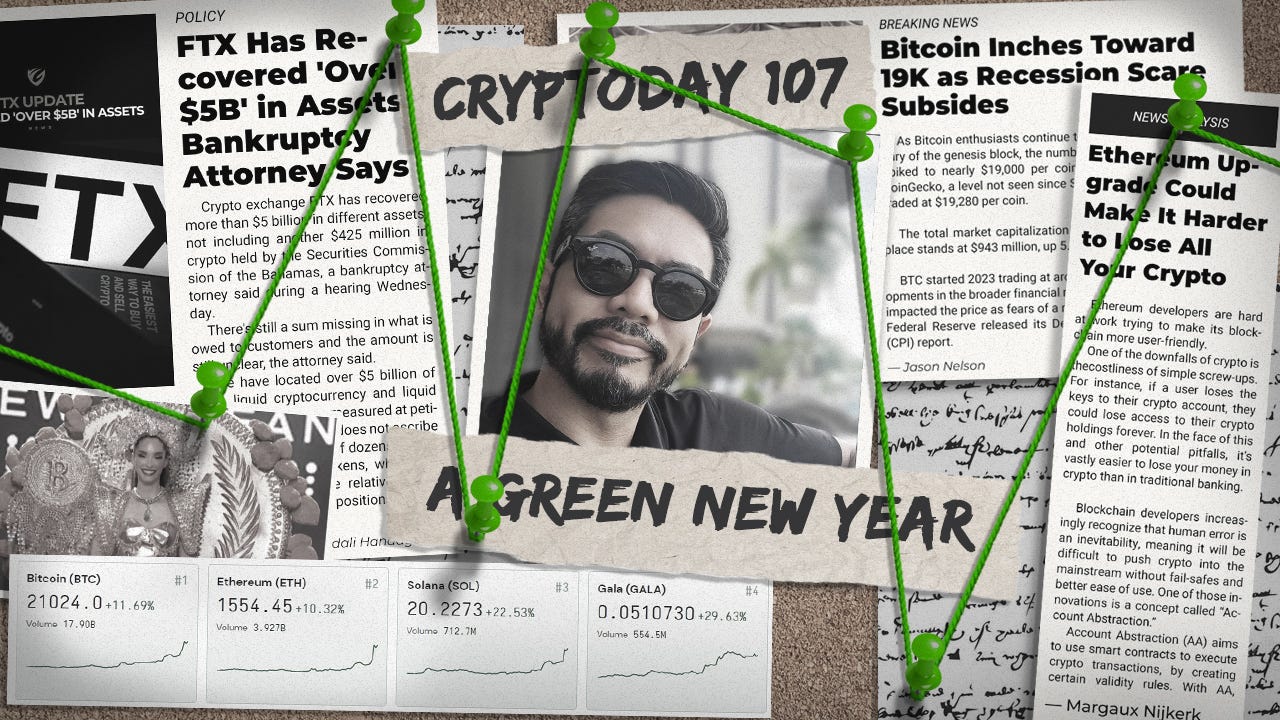

A Green New Year!

CRYPTODAY 107

We’re now exactly two weeks into 2023, and we’ve already seen some fireworks in the crypto markets! Both $BTC and $ETH are up 30% since the year began, in what can only be described as A Very Reassuring Recovery. Did we finally find the floor of this bear market cycle last December? Possibly. Global markets are starting to wake up again with the new Consumer Price Index (CPI) report from the US Federal Reserve showing that inflation is starting to slow down. Most of that inflation reduction was in fuel and travel: you may have noticed that a full tank of diesel has dropped from 80 pesos per liter in October to 68 pesos today. The reaction to the CPI news has been pretty apparent: nearly everything from the Dow Jones Industrial Average to FTX’s $FTT coin is green.

With $BTC and $ETH rallying at $21,000 and $1,550 respectively, where does that actually put us in the long-term view? Crypto’s last big drop of 2022 happened in the 48-hour period following FTX’s announcement that they were insolvent: $BTC crashed from $21,000 to $15,000 and $ETH plummeted from $1,600 to $1,000. We’re back at those levels now and the outlook is shaping up to be quite positive. (To be honest, I’ve rewritten this particular paragraph 3x over the last 24 hours because the price levels kept going up each time I thought I was done!)

Last December, I decided that I should start putting my money where my mouth is, as it were, regarding my predictions here on Cryptoday. So I set aside a modest $1,000 fund to speculate on futures at the decentralized derivatives market ApeX. For the technical folks, ApeX is a young exchange supported by ByBit and built with zero-knowledge proof technology provided by Starkware. They have a rewards token called $BANA that is used to incentive trading activities (you collect these as you trade), and a governance token called $APEX. So far my experience over these last 6 weeks has been pretty solid: your funds are not held by a third party in the way they would be if you had deposited at Binance (or FTX). At the same time, you get to enjoy the speed and responsiveness of a normal exchange.

Now, my trading thesis was pretty straightforward: I bet on the market dropping in mid-December and recovering in mid-January. With these recent market moves, I’ve more than doubled my money. That’s not to say that I got all of my bets correct: there were a couple of weeks in December where I was underwater by nearly $400, because I either mistimed my entry or didn’t have the conviction to stick to my guns. But overall, I’ve made nearly $2,000 in net profit, and I’ve been diligently withdrawing my gains instead of keeping them in play. The idea is that I maintain a trading position of only $1,000 on the exchange at all times, to reduce security or technology risk. Or the mental risk of making excessively large bets just because I have access to more money. It also helps that I’ve received over $150 in exchange fee kickbacks, since ApeX has been incentivizing new traders with their $BANA token rewards.

The next big economic event to watch out for is the first Fed meeting of the year, on February 1st, where they are expected to announce a slightly smaller interest rate hike. This contrasts with four of the last five meetings, which each added 0.75% to the overall interest rate. Only the December meeting had a smaller 0.5% hike, which is the number we’re expecting in February as well. If that’s the case, I think $BTC has a clear path back to $23,000 over the next 2-3 weeks. A price gain of this magnitude would put us back to where we were before FTX collapsed and importantly reassert the $20,000 psychological level as our bear market backstop.

Trade safely, cryptofam!