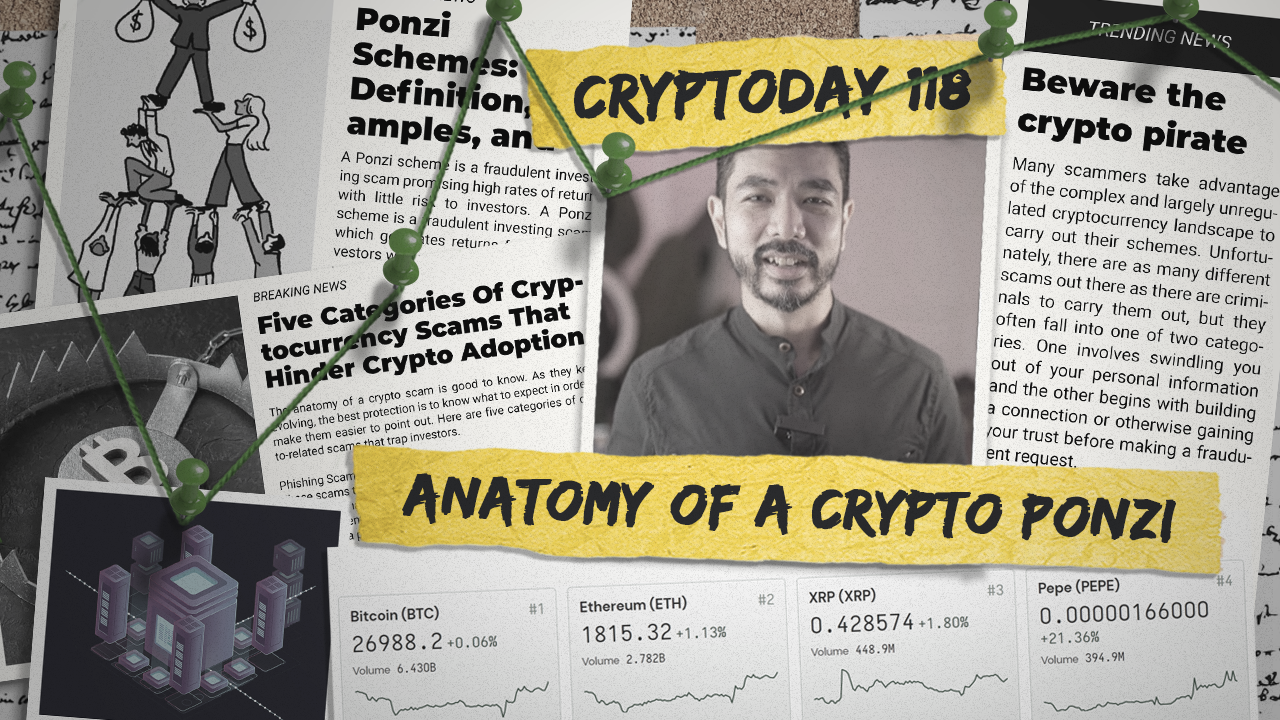

Anatomy of a Crypto Ponzi

CRYPTODAY 118

Yesterday a few readers asked me to check out a new platform called CryptoHubFinance, which has been promoting its coming public sale on places like Marvin Favis’ Youtube channel and in a few trading groups on FB. As far as I can tell, their presale wallet has accumulated around $22,000 in funds so far, so I guess there are enough people investing in this to warrant an investigation. TLDR; CryptoHubFinance (CHF) is a PONZI scheme, and I strongly recommend that you AVOID it. Let’s dive in to the details!

On CHF’s homepage, they promise a fixed 2% daily yield with a minimum $50 investment. Honestly, we could stop right there and already conclude that this is a ponzi scheme, because there’s no way on Earth that you can guarantee a fixed 700%+ annual gain without breaking the laws of financial physics. Although it’s entirely possible for traders to outperform the market, no one ever guarantees a fixed rate because no one can predict the future. And of course, the CHF team knows that. But they also know that there’s no binding legal agreement between them and their investors, so they can say anything they want and you can’t sue them for lying to you. There are no photos of their founders, no office address, no business information … not even a telephone number that you could call. Now I do understand that for some crypto projects, this kind of anonymity is quite normal, so let’s keep going and see what else we can uncover.

Like every crypto project, CHF features a whitepaper that attempts to explain how it all works. However, their whitepaper offers no details for how the system generates any of the yields that it’s promising. This is the polar opposite of what a real whitepaper is supposed to do; it should describe in vivid detail exactly what makes this project unique. Otherwise, how would a discerning investor know whether it’s worth supporting or not? They list five “Hub Use Cases” that include Money-laundering protection, P2P transactions, etc, but other than one sentence describing what those words mean, they do not explain how they plan on accomplishing any of those things. (And in case you’re thinking that this is confidential or proprietary information, that’s not how a supposedly open-source and transparent crypto project is supposed to work.) Their product roadmap ends in 2024, and simply states that at that stage they will be focusing on “Marketing and Propagation.”

To make sure that I wasn’t just imagining all this, I took a look at the actual smart contract code that governed the CHF “HubToken.” The nice thing about smart contracts is that they’re deployed on the blockchain in a fully transparent and readable form, so you can’t really hide how they work. When a scammer deploys a smart contract, they are basically revealing themselves and hoping that no one notices. (Remember Forsage back in 2020?) The contract that manages the CHF token sale is listed right on their website and you can view it through BSCscan. The first thing I noticed was that it contained the wallet addresses of its developers and automatically pays 10% of all funds to those addresses. That’s a little bit strange, but perhaps potential investors are already informed of this “developer tax” when they hear the sales pitch. The other thing I noticed was that it used MLM jargon like “upline” and “downline,” but that could just be a poor choice of words on the part of the programmers.

More importantly, however, the CHF developers didn’t renounce their ownership of the HubToken smart contract when it was deployed. Why is that relevant? Well, once a smart contract is deployed on the blockchain, it’s considered best practice for the original owner to “renounce” their ownership. Since the owner has the private keys of the contract, renouncing ownership prevents them from taking control of the funds that are secured within it. But because the CHF team never did that, they could remove funds as easily as transferring tokens thru Metamask. This ownership control is relevant in another way — the contract also happens to include the ability to pause payouts and ban investors. Basically, this means that the CHF team has full centralized control over their token, its issuance and rewards, and even its individual holders.

You don’t need to take my word for any of this. The code is right there, but if you’re not confident reading it directly, you could just use one of the many free online scam-detector tools. The most well-known scam detector is TokenSniffer, but there’s also BSCheck, IsThisCoinAScam, and a few others. TokenSniffer gives CHF’s HubToken a safety score of ZERO out of 100, and observes that the contract allows more tokens to be issued over and above the initial supply. This is an important warning because one of CHF’s main claims is that their supply is always limited to 28M tokens, but it appears that there’s nothing in their code that prevents them from adding more whenever they want. BSCheck evaluates CHF as “risky” and agrees with the TokenSniffer evaluation.

Why are scams like this so popular in the Philippines? The prevailing opinion is that Filipinos are hungry for opportunities and are willing to be reckless with their funds in order to find a breakthrough. But there’s another more devious reason too. I believe that the people who promote platforms like CryptoHubFinance actually know deep down that they’re endorsing an unsustainable investment scheme that will eventually collapse. But they also know that ponzis can be profitable as long as they can get in before you do. They’re literally just using you to fill their downline. I suppose there’s also the remote possibility that some of these influencers actually believe that guaranteed 2% daily returns do exist, and I honestly don’t know which of those possibilities is worse. Would you rather be following the advice of someone who is using you to enrich themselves, or someone who doesn’t actually comprehend the thing they’re promoting? In either scenario, you’re still the one losing money.

Be careful out there, cryptofam!

PS. Special thanks to Paul Soliman and Gelo Wong of Likha for spending time collecting data and contributing their insights to this essay. (And congrats on your successful NFT drop with GCash!)

Funny that checking their site now, it's gone. Classic rug pull.