Binance P2P Now Supports SLP; Lyka Gems Halted

CRYPTODAY 024

On Friday, the Bangko Sentral published an order for the popular social payments platform Lyka to stop their operations in the Philippines. The reason? Lyka had never registered as an “operator of payment system” (OPS) and was therefore not allowed to offer such services to Filipino customers. The full list of registered OPS’s can be found here, and includes all the companies that you expect to see like GCash, PayMaya, and CoinsPH, and some that you definitely did not, like Razer and Zomato. The BSP noted in their virtual press interview that Lyka had “expressed their willingness to register,” which is typically what companies say when they’ve really been given no choice in the matter.

I confess that, before this news, I was only aware of Lyka because of all their celebrity endorsements. Their PR department is a well-oiled machine, and will probably have no problems reassuring their customers that everything is just fine. Indeed, literally hours after the news broke, the #LykaWillAlwaysBeHere hashtag began circulating on Facebook. People like Ivana Alawi, Julia Barretto, Liza Soberano, and Pia Wurtzbach, and companies like CleanFuel, Tim Hortons, and Anytime Fitness, are all going to have to rethink their partnerships with the brand now however. This is especially true if the regulatory process is messier than expected. Other than becoming a registered OPS, it seems reasonable to expect that Lyka will also be asked to apply for an electronic-money issuer (EMI) license, which is a much more expensive and complicated license to pursue in this country. If their GEMs are supposed to be “as good as cash,” then this will be necessary at some point.

I signed up for Lyka on Friday afternoon to check what was happening inside the app itself. They appear to have suspended the “Buy GEMs” feature, which is how Filipino customers would typically add funds to their Lyka balance.

Since I have no Lyka GEMs and also no way to deposit funds, I couldn’t test whether they had actually suspended their payments service. If I have any readers out there who do, please let me know about your experience in the comments!

Is Lyka a scam? The BSP does not appear to think so, given that they invited them to register as an OPS. If they thought it was an outright scam, then the notice would’ve come from the SEC, and it would have been worded much more sternly. We also shouldn’t assume that Lyka’s intentions are malicious, when it’s far more likely that they were just incompetent. (This line of reasoning is called “Hanlon’s Razor.”) Why do I think they were incompetent, humorously or otherwise? Well, they’ve been operating in the Philippines for a couple of years now, and there’s over 150 competing payments companies currently registered as OPS’s. Surely this requirement was not new information to them; the National Payments System Act was published in 2018.

Do I think that Lyka GEMs are a solid investment? I never have, and I probably never will. I come from the crypto world, and typically when we see celebrities endorsing a monetary system by showing off their luxury purchases, that’s a warning sign to stay away. This is not because I have anything against celebrities; it is simply because celebrity endorsements have a ponzi-like effect on a currency, making it impossible to judge whether something is actually sustainable. And if I can’t evaluate a thing directly, then I won’t participate in it. I’ll continue to monitor this closely of course, and if it turns out I’m wrong about Lyka, I won’t be shy about admitting it.

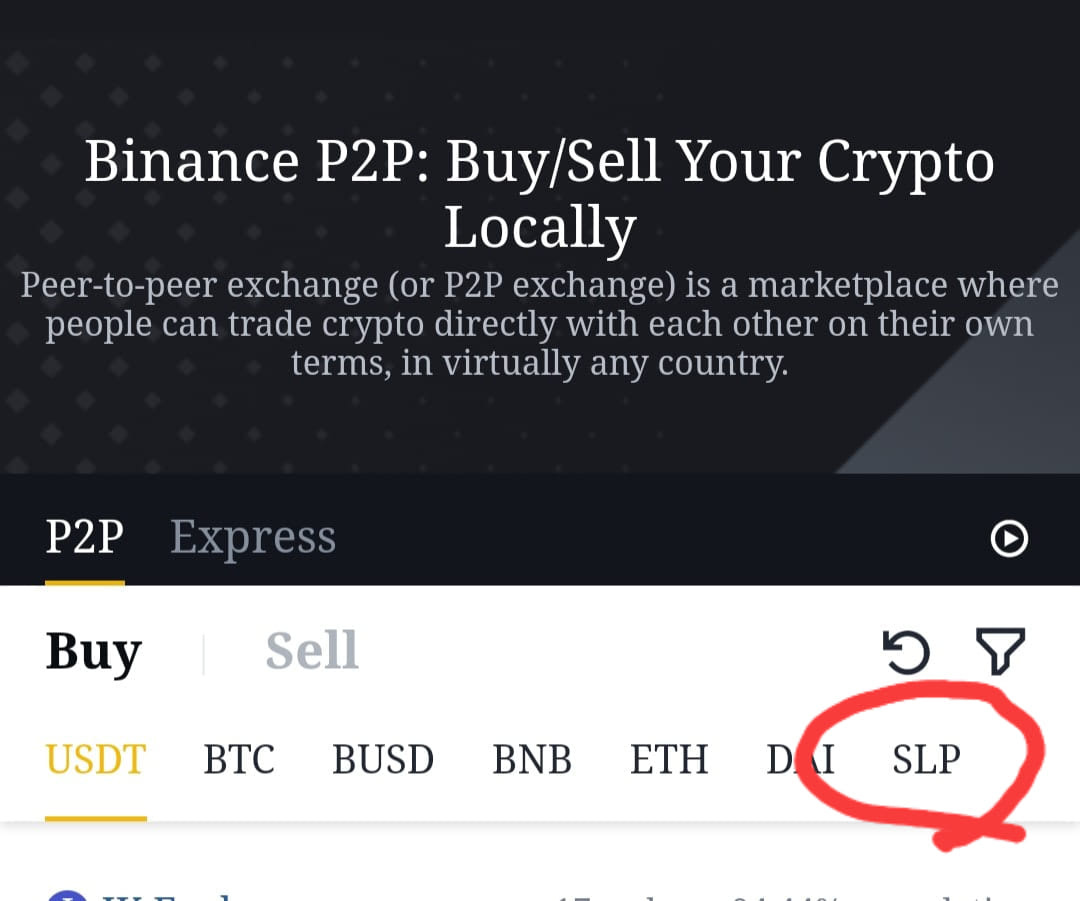

$AXS did indeed break through its ATH over the weekend, as I anticipated in my Friday letter. On Saturday it set a new ATH of $49, before settling in this morning at $41. Coincidentally, that ATH happened right after an announcement that I was also anticipating: the Binance P2P marketplace now directly supports trading of SLP and PHP.

It may not be immediately obvious how big a deal this is for the Axie Philippines community. Back in 2020, the only way Axie players could exchange their SLP earnings to PHP was to (1) do an SLP-to-ETH conversion on Uniswap, incurring a $10 gas fee and ~1% exchange loss, and then (2) sending those earnings to Coins.ph, where they would incur another ~2% exchange loss and Instapay withdrawal fee. Then my company BloomX came along and shortened the path so that you could trade SLP directly into PHP, and withdraw it to your bank account all within the same platform. The Binance P2P approach is arguably even more direct, because it allows the community to be completely self-sustaining. Now the community members can safely trade amongst themselves, by posting an ad on P2P.binance.com and waiting for another community member to take their offer. The platform determines the correct real-time price and very importantly provides a safe escrow for their transaction, so no one can screw up. Of course, we do hope you still consider BloomX as one of your trusted trading channels, if you want an even faster trading experience!

If you’re a member of the Axie community, you’re probably wondering right now if the game could be ordered by the BSP/SEC/some other government agency to stop operations in the same way that Lyka was. I think this is a very valid concern as more Filipinos start to find a livelihood in play-to-earn, and it deserves to be discussed. Although the answer to this question is unknowable until it actually happens, I think we can make some predictions based on how the government has dealt with crypto projects in the past. Is Axie a payments system? No, so they wouldn’t be asked to stop operations on the same grounds as Lyka. Is it a type of money? Technically yes, but they are not actively soliciting Filipino customers to use their AXS or SLP tokens. SkyMavis only wants people to play its game, and it’s the gamers themselves that are soliciting other gamers. This is a critical distinction that puts it outside of the BSP jurisdiction, because the game platform itself doesn’t engage in the conversion of peso to crypto, and only accepts payments within its own ecosystem. What does Axie resemble then? Well, right now, to most people, it looks like a crypto-based investment opportunity.

Back in 2020, the SEC issued a cease-and-desist order to Forsage, a decentralized ponzi scheme that was built with Ethereum. There was no Forsage business entity in the Philippines to send demand letters to, and there were no local Forsage bank accounts to freeze. There were also no business fundamentals to speak of. The only footprint Forsage had in the Philippines was a massive group of Pinoy Youtubers and FB groups, all of whom were teaching other Filipinos how to buy ETH and how to send that ETH to the Forsage smart contract. Now, before you go nuts, I’m NOT saying that Axie is a ponzi scheme like Forsage, but unfortunately that situation is the closest thing that this government has dealt with in terms of unregulated decentralized finance. Do I think that there’s a possibility that the SEC will treat Axie this same way? Forsage had no business fundamentals, and it was very easy to detect that it was a ponzi. So if the government does go after Axie, it will be for different reasons, but as a community we need to already start thinking about what those reasons might be. If community leaders want to get together and talk about this on a FB livestream one of these days, I’d love to join as a moderator or host!

See you all on Wednesday, cryptofam, and stay safe out there!

Yes, the Axie community leadership needs to be one step ahead of their game. There are several crypto communities that doesn't seem to care about setting up shop in the Philippines. Binance for example. No SEC. Considering that HK, UK and other countries have already started questioning them on that issue.

Hi Luis, is the BloomX payment platform already live? In the site you need to join a waitlist? I also sent a message via FB and never got a response