Bitcoin Now 56% Clean? Probably Not.

CRYPTODAY 015

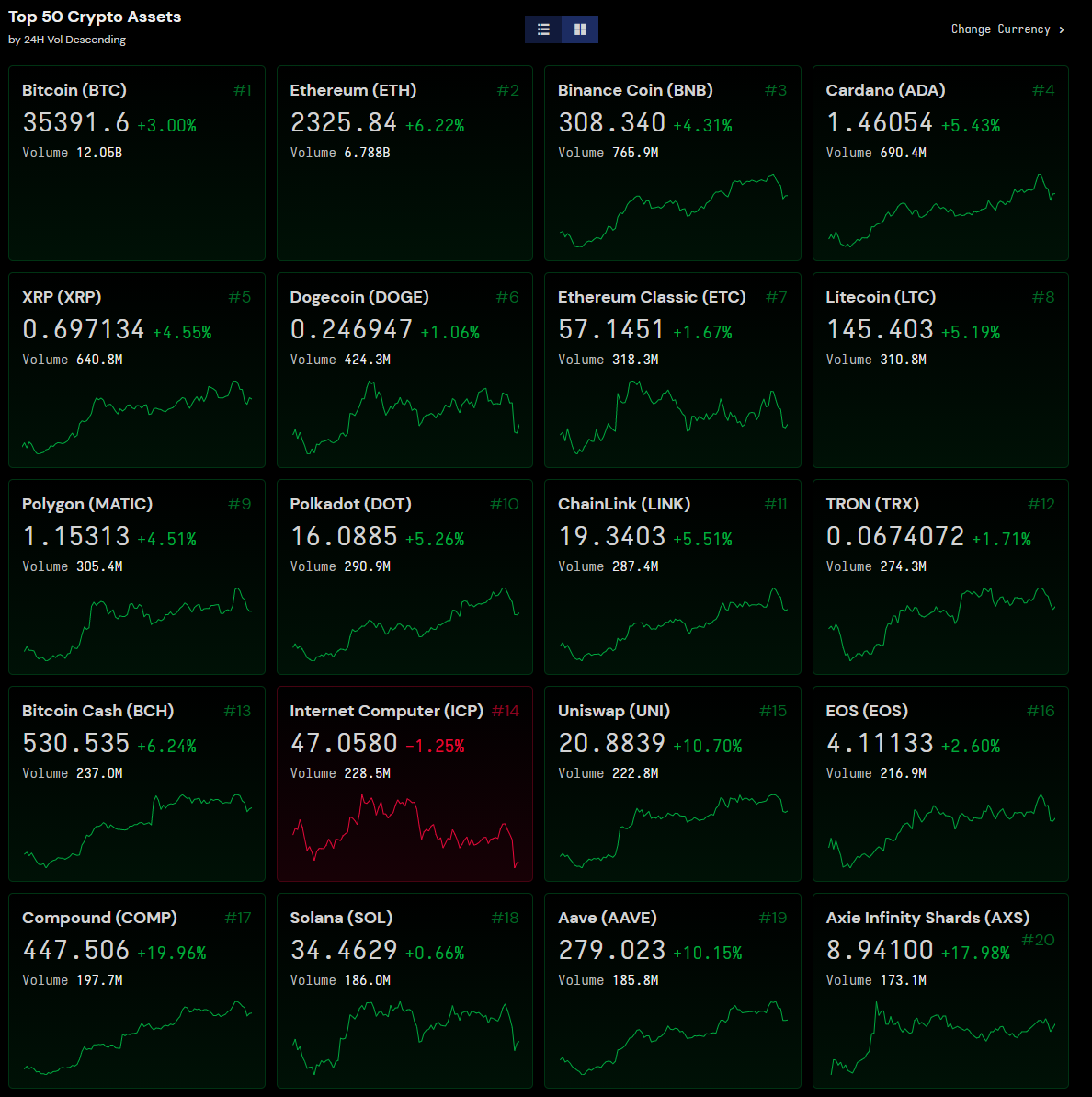

It’s a green, green Monday, with nearly everything in the top 20 showing at least 5% growth, and some big winners like $AXS — the governance token that powers the popular Axie Infinity game — doubling its price over the last week. Even $SLP, the game’s utility token, saw over 30% gains since Friday, which is counter-intuitive since you would expect the players to be cashing out their earnings at the end of the month. Based on BloomX’s data, we KNOW that players were definitely liquidating SLP all of last week, but that sell pressure did not seem to stop the price from rallying. Axie Infinity has been crushing the news cycle recently by, amongst other things, topping the DApp charts in terms of protocol revenue.

Last Friday, the Bitcoin Mining Council (BMC) published its first salvo in the ongoing information war. The headline is exactly what you would expect from an organization formed specifically to combat the Bitcoin-is-bad-for-the-environment narrative: Bitcoin mining now uses 56% sustainable energy. But here at Cryptoday, we like to verify our data before we retweet it, so let’s dive in, shall we? (Download the full presentation here if you want to follow along.)

I immediately have issues with the very first slide, which claims that the 23 members of the mining council account for “32% of the network.”

This is probably true RIGHT NOW, but remember that most of the Chinese mining operators are in the middle of relocating to Kazakhstan or Russia, and thus are not online. (We know this from the global hashrate, which last week dropped 35%, and is down 50% overall since the Chinese ban started.) An earlier estimate of the Bitcoin Mining Council’s list of members pegged their overall output at just 10%, and their collective capacity is currently over-represented due to the absence of their Chinese counterparts.

The second thing I don’t like is that their primary research methodology was an in-house survey on their own members. That’s about as reliable as me telling you that 100% of BloomX employees are happy with their jobs. (I mean, I’d like to think that that’s true, but that’s not credible research.)

To say that the BMC is deeply incentivized to share a very specific result would be an understatement. The chart above estimates that 56% of the world’s Bitcoin mining industry is sustainable, but if you zoom in on the fine print at the bottom, that figure is based on “analysis, assumptions, and extrapolation” … meaning that they took their members’ data and mapped it over a much larger part of the industry that is notoriously secretive about its energy sources and practices. That 56% also just happens to be slightly above the minimum amount that Elon Musk asked for before considering Bitcoin for Tesla payments again. Go figure.

Binance P2P, the biggest peer-to-peer platform in the Philippines, has announced that it will be finally charging for its services, over a year after it first kicked off the platform. I was looking at the new price chart and found it curious that the scheme is the reverse of how they charge in their spot exchange. To understand why, I’ll need to explain what makers and takers are.

Every trade has two parties, and we refer to them as the Maker and the Taker. The Maker sets a price (e.g., “I want to sell 1 Bitcoin at 1.5M PHP” or “I want to buy 1 ETH for 100k PHP”), and the Taker hunts for the most affordable price that matches his target volume (e.g., “I want to buy 0.1 Bitcoin, so I can afford that 1.5M PHP asking price”). When a Maker and a Taker agree on a price, a trade is executed and the platform earns a small commission from both parties. Makers maintain the liquidity in an exchange, which is why in the Binance Spot market, the fees for the makers are only half what the takers pay. The simplest way to say it is that the exchange WANTS the makers to keep their funds on the book, so they charge them less. (In a few exchanges that BloomX trades in, the maker fees are actually zero, whereas the taker fees are 0.2% or more.)

So what’s interesting about the Binance P2P announcement is that they’ve reversed the incentives. The makers are charged 0.2% and the takers are charged nothing. Why is this the case? My read is that the P2P platform on Binance is the closest thing they currently have to a fiat on-ramp for their customers. If you’re a Binance user right now and wanted to deposit some funds, your only choice* would be to find a vendor in the P2P marketplace who’s selling USDT in exchange for pesos. Binance isn’t charging its takers (i.e., you) because they’re attempting to reduce the friction of fiat deposits and withdrawals. (*Unless you’re an approved BloomX customer of course!)

The Philippine Stock Exchange has announced their interest in adding cryptocurrencies to their supported assets. (GCash announced similar interest about a month ago in an interview that was widely shared by the mainstream media.) My initial reaction was to chuckle at the idea of only trading crypto between 9am and 1pm from Mondays to Fridays. Given that the biggest market moves always occur outside of the PSE’s official working hours, they are going to be in for a real culture shock. On the other hand, maybe that’s a good thing?

What does the PSE need in order to get a $BTC ticker up on their LED display in BGC? Well, firstly some more specific guidelines from the SEC, as mentioned by CEO Ramon Monzon. In order to actually implement this however, they’d need a clearing partner that can provide them with crypto liquidity, market-marking, and secure custody, something that would otherwise take 2 years or more to build. Given the market’s current proclivities, it is very likely that that clearing partner would need to support $DOGE and all the other alts. And in case you’re still wondering where I’m going with this: I’m pretty sure our company fits that bill. ❤

For the rest of July, I’m going to experiment with making Cryptoday a M-W-F newsletter instead of every-weekday-morning. Primarily this is to give myself a day to breathe in between editions, but also to force myself to only focus on the bigger, market-moving issues and not sweat the small stuff. Please let me know in the comments if you prefer a different strategy altogether!

See you all on Wednesday, cryptofam!

I absolutely enjoy Cryptoday. If a shift to a MWF schedule makes it any better then I'm all for it. Thanks again!