Earning from Katana (Part 1)

CRYPTODAY 056

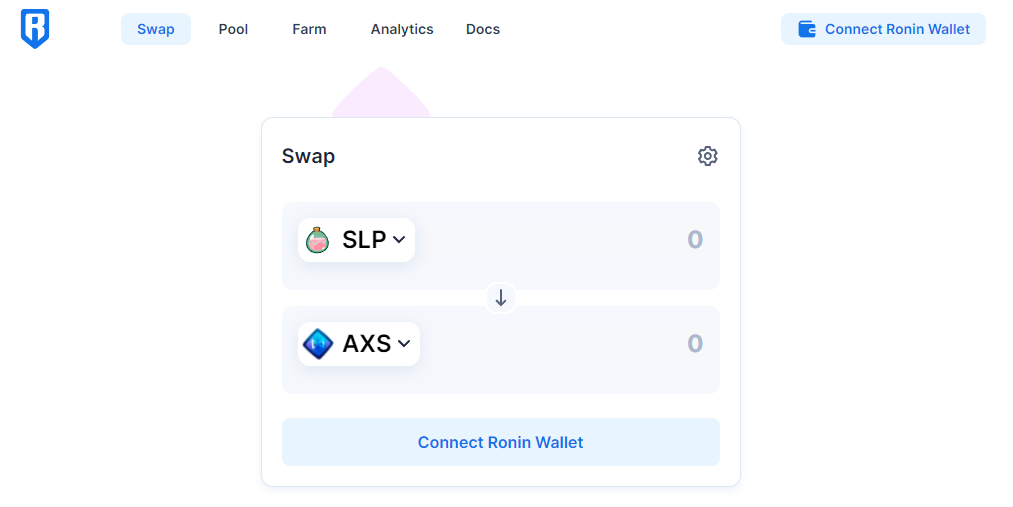

The long-awaited decentralized exchange (DEX) for Axie Infinity players, Katana, went live on Thursday afternoon, and the resulting price pump on both $AXS and $SLP was, unsurprisingly, quite substantial. Within minutes of the announcement, both tokens were clocking in at 10% gains, and as of this morning $SLP is above the all-important 5.00-peso price level. Katana looks like it was heavily inspired by the SushiSwap and farming strategy, so if you’re familiar with Sushi you’ll breeze through SkyMavis’ new trading platform. For users who aren’t familiar with Sushi or DEX’s in general, I’m going to dedicate this entire newsletter (and next week’s letter as well) to talking about how to use this new platform to generate some extra income.

But first! Why does Katana even exist? Well, because SkyMavis is trying to build an entire universe of services within its Ronin blockchain, so that players won’t have to pay for expensive gas fees crossing into the Ethereum base layer. One of the most important services, as I explained in a previous letter, is a way to convert the players’ earnings from SLP to some other cryptocurrency. In that letter, I also regrettably stated that I didn’t think the average player would feel a big impact when Katana launched, but I’m now rethinking some of those sentiments. Why? Because for many Axie players this will be their first experience using a decentralized exchange (DEX) that actually allows them to trade as users but also earn as liquidity providers.

In order to understand what that means, we first need to understand how a DEX works. Every DEX is just a place for buyers and sellers to exchange their cryptos. Let’s say you’re an Axie player with your month’s SLP earnings, and you are thinking of exchanging it for AXS. Maybe you’ve heard of the awesome 100%+ annual returns in the AXS Staking Pool. Without Katana, you would normally have to send your SLP to Binance, exchange it to USDT, buy AXS with that USDT, and then withdraw the AXS back into your Ronin wallet. All of this takes time and incurs quite a few costs along the way. With Katana, all you have to do is go to Katana.roninchain.com and swap your SLP for AXS, and you’re done in 10 seconds.

If you’re wondering what magic has occurred behind the scenes to make that possible, well, that’s what Cryptoday is for! Whenever a user goes on a DEX and tries to swap their crypto for something else, what they’re actually doing is trading with a group of other users who have all chipped in some of their own crypto to support the DEX. We call these users liquidity providers (or LP for short). These users don’t just support the DEX because they’re awesome people, they’re doing it because they earn a cut of the trading fees. In the case of Katana, the LPs earn 0.25% of every trade. You can see how much the LPs have made in real-time by going to the Analytics page for Katana — within the first three hours since it launched, over $55,000 in fees had already been paid out. Each LP earns fees proportionate to the size of their deposit in the total pool, so if your deposit accounts for 1% of the total pool, then you make 1% of that $55,000.

How do you become a Liquidity Provider? That’s either easy or hard, depending on how willing you are to try something new. The first thing you need to know is that being a liquidity provider in Katana is very different from being an AXS staker. In the latter platform, all you have to do is decide how much AXS you want to deposit, and then you just sit back and watch your deposit grow a little bit every few minutes. As a Katana liquidity provider though, you need to not only decide how much AXS you want to contribute to the pool, but you also have to provide its equivalent in WETH. This is because the liquidity pool must always have an equal amount of AXS and WETH in order for the trading to work. So if you had 10 AXS, for example, you can’t just deposit that. You also need to have 0.8 WETH (or whatever the current equivalent was at the time), and deposit that much as well. This AXS-WETH relationship is what we refer to as trading pairs, and it works the same way for SLP-WETH, WETH-USDC, etc. So if you wanted to support the WETH-USDC pool, you would need to have 4500 USDC for every 1 WETH that you deposit. (This still works even if you only had 45 USDC, you just need 0.01 WETH, as long as the ratio is maintained.)

Once you’ve decided how much AXS and WETH you are willing to deposit, you just hit the Add Liquidity button and then you sit back and wait for your share of the trading fees to roll in. As an experiment, I added liquidity to both the SLP-WETH and AXS-WETH pools, but I made my SLP-WETH contribution about 20% larger than AXS-WETH because my sense was that it would become the more popular trading pair. Within the first four hours I had earned $50 in fees from my SLP-WETH contribution, but only $20 from my AXS-WETH, so I guess that theory was mostly correct, at least for now. (When I checked again this morning, I had earned $160 from SLP-WETH fees, and only $47 from AXS-WETH, so if anything the theory is becoming more correct as time has passed.)

As you become more familiar with LPing, there are a few things that you will notice. The first is that the size of your deposits change on a minute-by-minute basis, which was something that initially freaked me out when I first started pooling YGG-WETH on Sushi.com. I originally put in 1000 YGG and then somehow it dropped to 980? What’s going on here?? The short answer is that the pool is rebalancing itself in real-time. Remember that both sides of a trading pair must always be of equal value, so if one crypto (AXS) starts to go up in price, then you will see your AXS deposit amount go down, and your WETH deposit amount go up. This is totally normal … although admittedly, very disconcerting if you’ve never seen something like this before. They’re still equal in value, but now you have less of one, and more of the other. For as long as you don’t withdraw your liquidity, you won’t actually feel the effects of these internal adjustments. This is called impermanent loss, and is a concept that you’ll need to be comfortable with if you ever want to be a serious LP. You should not be an LP for a given trading pair if you aren’t 100% OK with having both of those tokens in your portfolio, because there’s a chance that you may come away from the whole experience with a lot more of one, and not a whole lot of the other. In the case of my Sushi YGG-WETH pool, I’m totally fine with either lots of YGG or lots of WETH, because I could simply use one to buy the other in order to rebalance my position again later on.

You’re probably wondering if LPing is really something that the average Axie player should look into, given that it’s a bit complicated and also has the possibility of impermanent loss. I personally don’t think it’s a requirement, but I also know that based on our YGG survey data, nearly 40% of you here in the Philippines are choosing to hold your SLP in order to wait for a better exchange rate. If you’re thinking about holding your SLP, I think that the correct strategy is to convert it into AXS and then stake it. You can do it on Katana now, and not even have to leave the Ronin blockchain.

When I stake my crypto, I am earning regular income from it. I am “putting my money to work.” If I instead just HODL my crypto, as is the case with the Bitcoin sitting in your cold wallets, it’s a sleeping asset. (This is why Bitcoin often gets referred to by DeFi enthusiasts as your “pet rock.”) The only way I can earn from it is when the price goes up, and I have to sell off some or all of the original capital. Staking allows you to maintain the original capital position and just sell off the yield, and if you have enough, you can put yourself in a position where the original capital is maintained forever. To crystallize this idea: if you owned 100 AXS (roughly $14,000 in current prices), you could stake that right now and earn about $1,000 per month. Note that this would be true even if the AXS price drops by 20%. And at the end of the 12-month period, after having earned over 500,000 pesos while sitting around doing nothing, your original 100 AXS would still be intact! You may not have the time to learn to become an LP, but if you stake your AXS, it will grow very quickly.

On next week’s Cryptoday, I’ll be talking about the Farming feature of Katana, which wasn’t completely ready yet when I first started exploring the exchange, and deserves its own full essay. Being able to earn the new token $RON adds a totally new dimension to this whole conversation!

See you all next Friday, axiefam!

Clear and concise as always, thanks!

Nice read!

Question/Request: Which local DEX do you recommend? I hope you can reserve one Cryptoday for this one. I still need clarity which ones i should be using or using more of. PDAX? Coins.PH? BloomX? Thanks and more power!