Earning from Katana (Part 2)

CRYPTODAY 058

It’s now been a full week since SkyMavis’ decentralized exchange Katana went live, and I have enough data to offer some practical advice. Here’s the TLDR; We can’t judge Katana profitability based on the trading fees. If we do that, then it is far less profitable than AXS staking. The only way to evaluate it is by estimating the future value of the $RON rewards. This is going to get technical!

First, let’s look at the main thing we are comparing this investment opportunity to: stake.axieinfinity.com. The pool currently generates over 110% per annum in returns, or 9% per month. If you deposited 30 AXS right now, you’d be earning a monthly “salary” of PHP 15,000 purely from your staking rewards. In terms of passive income streams, it’s hard to beat this. Of course, most people don’t have 30 AXS (~PHP 210,000) just lying around. Thankfully, SkyMavis already gave us the primary method for doing so: just play Axie Infinity and save up your earnings. If you’re diligent about converting your SLP rewards into AXS and then immediately staking them each month, you’ll hit the 30 AXS target within a year. It may not be instant, but it’s a relatively low-risk investment strategy that transforms active income into passive returns.

Now let’s get back to Katana. We already know that people who support the exchange by lending their capital to it receive regular kickbacks of $RON tokens. These are called Liquidity Providers, or LPs for short. I’ve been LPing since Katana launched, and now have a few hundred $RON allocated to me. We also know that $RON is not currently withdrawable yet, and indeed it’s not useable for anything yet even if we could withdraw it. Eventually, it will be the only way to pay for transactions on the Ronin blockchain, but for now, we are collectively making a bet that $RON will be worth some non-zero number when we receive our respective allocations. The question, of course, is precisely how much it will be worth.

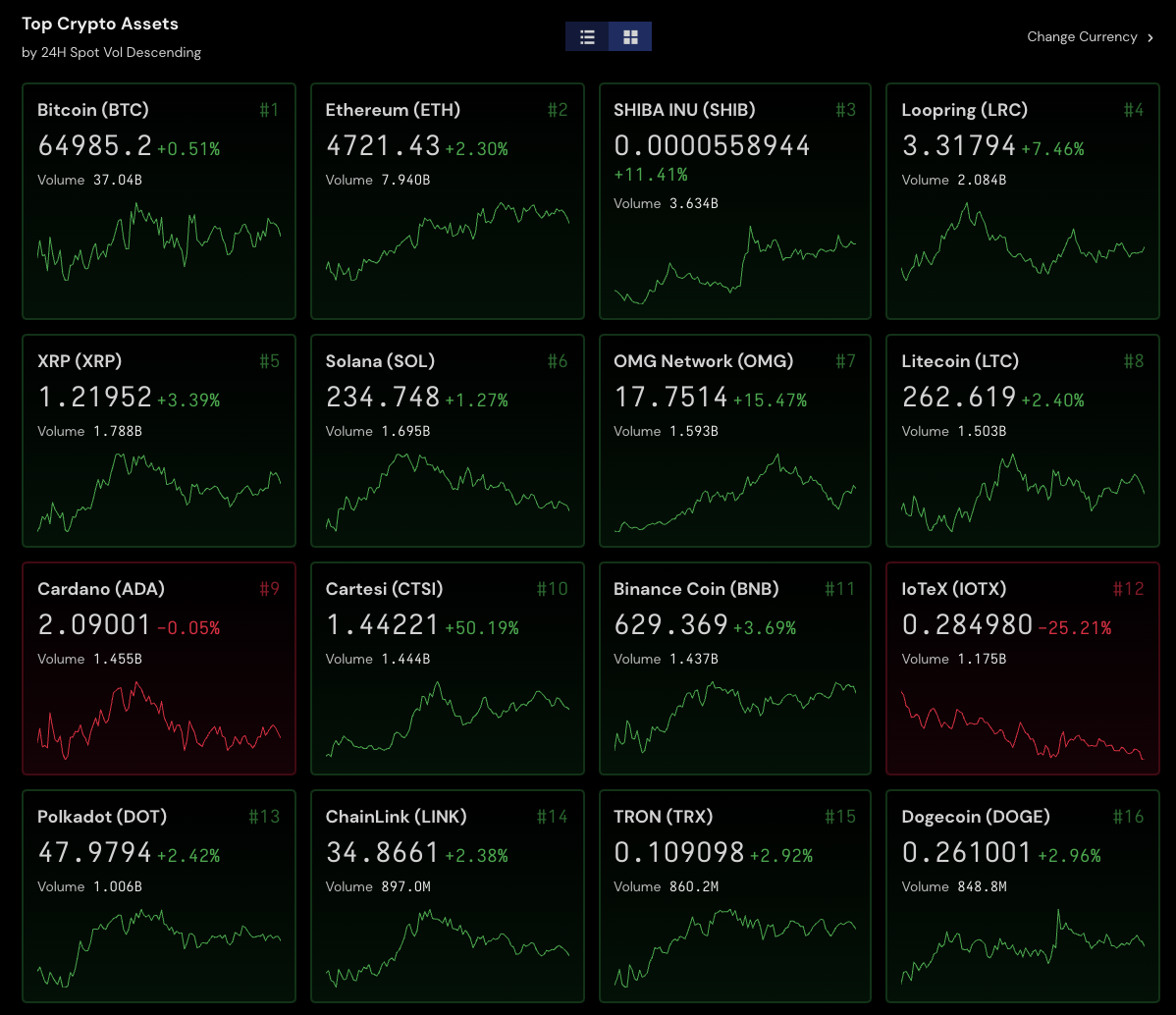

In order to evaluate what that future price might be, we need to first understand what $RON actually is. According to SkyMavis, it’s the token that represents the Ronin ecosystem, of which the Axie Infinity game and the Katana exchange are the two main brands. To make that easier to understand: we all know that the Marvel Cinematic Universe is one of the most lucrative movie franchises in history, but it is just one of the many notable brands within The Walt Disney Co. (They also own Pixar, Star Wars, ESPN, and Fox.) Conceptually, $RON is like buying stocks in Disney, and its price should be an indicator of how well the SkyMavis ecosystem as a whole is doing. What other cryptos can we compare this to? My first thought was Polygon Network ($MATIC), because it’s got a few obvious similarities with Ronin. They’re both Ethereum-dependent, and they’re both enabling blockchain applications on Layer 2, and they both use Proof-of-stake validators. $MATIC currently trades at $1.70. In terms of transaction volume, it averages about 4M transactions per day, while Ronin is currently at about 3M transactions per day.

Nearly all the $RON tokens in existence are sitting in a single address on the Ronin blockchain, waiting to be distributed to stakeholders Do I think that $RON will trade in the $2.00 range, like $MATIC? I struggled with this question all week, but ultimately the best answer I could come up with was this. We know that there’s about 1 billion $RON sitting in the first address on the Ronin blockchain right now. We know that every day, they are allocating 1.1 million $RON to all the people providing liquidity on Katana. That means that if the distribution schedule doesn’t change, it will take 900 days to fully distribute all the $RON in that address. By late April 2024, all $RON tokens should be in the hands of the stakeholders and community. Now, if $RON truly represents the ecosystem as a whole, it doesn’t make sense that its marketcap would be smaller than one of its “child” tokens, $AXS, which is trading at over $140 at a $9.5B marketcap. That would be like saying the Marvel Cinematic Universe is more valuable than Walt Disney Co, even though the latter owns the former. In the same way that $ETH itself has a bigger marketcap than all of its child tokens, $RON should eventualy have a marketcap that is the same or greater than $AXS.

So now finally, let’s go back to the all-important question. How much will $RON be worth? The way I like to think about it is this: if it’s not worth over $10, it has failed to “sell” the concept of being an ecosystem token, because it would have a marketcap that is less than $AXS. So although it may not begin trading at $10, it needs to hit that number in order to justify its own existence. I think SkyMavis will work hard to ensure that that is the case. Now, assuming we are in the ballpark with our $10 estimate, that means that annual returns for Katana LPs is about 300%, which would make it much more profitable than standard AXS staking. Now, before you start unstaking, don’t forget that the annual rate of return changes on a minute-to-minute basis depending on how big the total pool is. These estimates are based on a AXS-WETH pool size of $750M, and a SLP-WETH pool of $450M. The true profitability of $RON farming is knowable only in hindsight, because we can’t predict how big or small these pools will eventually be.

Please don’t ask me how long it’ll take for the market to arrive at a $10 price, because I am notoriously bad at judging timescales in crypto. For instance, I was on TV in late 2017 stating that Bitcoin was going to hit $50,000. I was off by 4 years! On the other hand, I was expecting my $ENS rewards from two days ago to be worth $50 by next year. It’s already over $60 as I write this. The best I can offer any of you right now is this. If you’re looking for a dead-simple investment with a straightforward real-time return, AXS staking is your most solid option. If you’ve got extra liquidity and want to make a bet on the future of the Ronin ecosystem, be a Katana LP. I’m currently doing both of these things, and the good news is that it’s easy to change your mind and rebalance your positions later on.

See you all next week, cryptofam!

"According to SkyMavis, it’s the token that represents the Ronin ecosystem, of which the Axie Infinity game and the Katana exchange are the two main brands." I hope you are right, but I don't think the Disney comparison is accurate, my understanding is that RON represents the value of the side chain and DEX (katana), which are services used by the axie game. But it doesn't mean all the implicit value from the game Axie infinity should be included in the Ronin chain. The game itself, community, players, etc... I would think of RON as a DEX + spinoff SaaS company, how much of it's value Axie would need to pay for some else provide them theses services? Certainly it's not cheap, but for sure it wouldn't be the total value of the game

Exciting to be a $RON hodler!