Investigating the Axie Phenomenon

CRYPTODAY 017

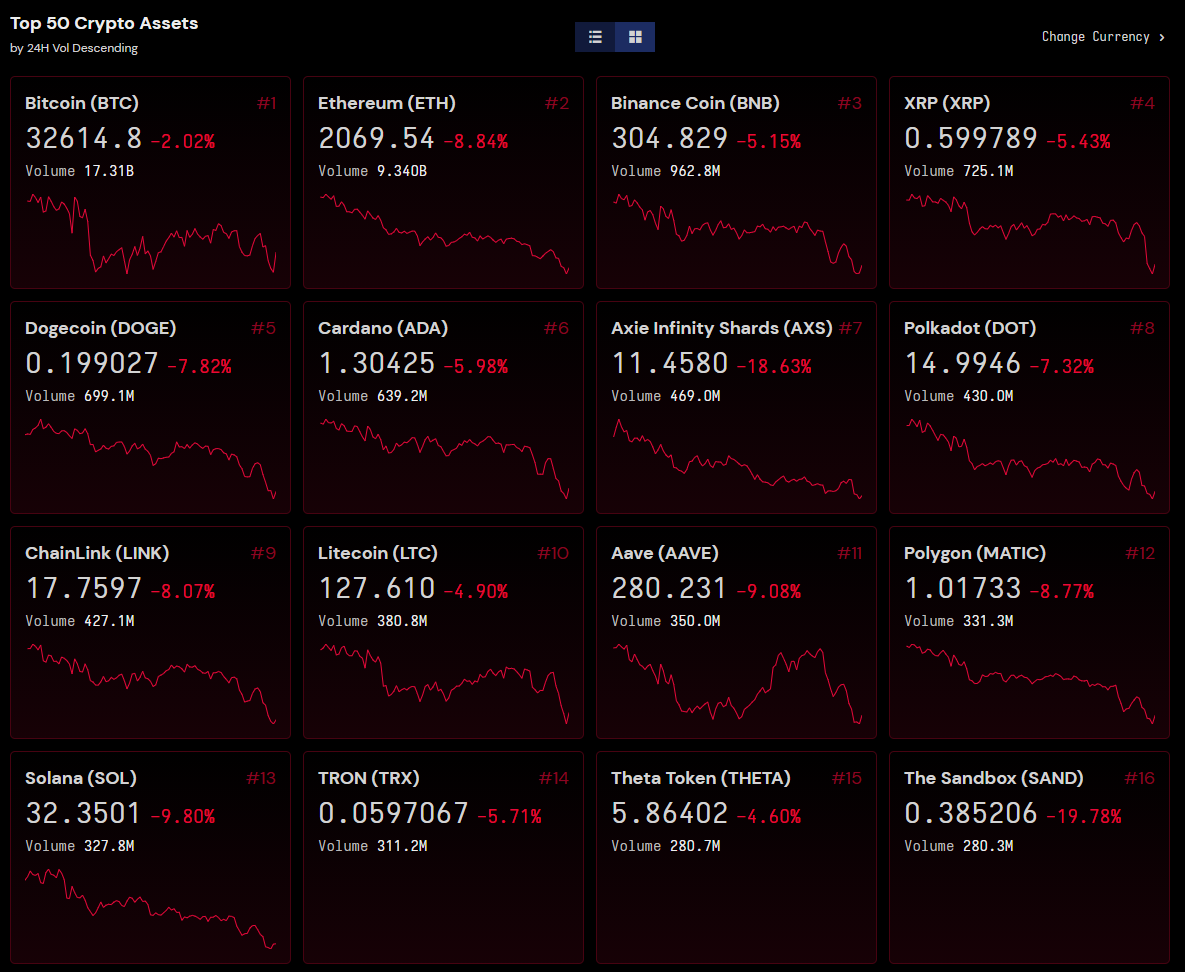

I’ve been building up to this all week with the jawdropping price action of the twin tokens $AXS and $SLP (+300% and +50% so far this month, respectively), so I think it’s finally time to do an executive summary of Axie Infinity, and explain why YOU need to be watching the Play-to-Earn corner of the crypto space.

First, the basics: Axie Infinity is an online game where players duel by pitting a trio of collectible creatures against each other. Think Pokemon, and you’re 90% of the way there. The creatures are called axies, and you can breed them to try to produce offspring with special abilities that make them more powerful, or other characteristics that are desirable to other collectors. Every time a player wins a duel, they are rewarded in $SLP. Every time a new axie is bred, it costs the breeder a combination of $SLP and $AXS. There’s now a growing population of young folks across the region who are playing this game full-time and earning good money from it.

So why should we care? Allow me, dear reader, to blow your fucking mind. The average daily active user count of Axie Infinity is 300,000, about 50% of which are Pinoys. Now, remember that these gamers are all playing for the rewards. The average player can earn 4,500 $SLP a month, so if we assume that about a third of those Pinoy players are playing at the optimal level, they are collectively going to earn 222,750,000 $SLP this month. How much is $SLP in peso terms? Well, as of this week, it’s over 9 pesos each, which means that these kids are cumulatively going to be raking in around 2 BILLION PESOS this month.

How accurate are these estimates? Well we can back-check June’s numbers quite easily by aggregating the blockchain data. The chart I made below compares SLP minted and issued to players vs SLP burned by breeders. (When a player claims his earnings for the month, fresh SLP is issued or “minted.”) 521 million SLP were minted last month, and if we use our same assumptions described in (3), this implies a total player cash purse of about 500 MILLION PHP, based on last month’s average SLP price of 6 pesos. This lines up quite well with our July estimate for player earnings, since BOTH the number of players are increasing AND the price of SLP is increasing.

To put that into perspective: 2 billion pesos is the average amount of remittances that ALL the OFWs living in Hong Kong send back home to the Philippines each month. But there are 800,000 of them stationed there! And don’t even get me started on how exploitative their living conditions are. Meanwhile, these Axie gamers are playing from their own bedrooms 3-4 hours a day, and making 4x as much. (Not to mention that they’re spending their money here, bolstering the local economy.)

But does it scale? A hundred thousand Pinoys is one thing, but we’ve got about 50M other adults who are underemployed right now. And perhaps even more big picture: Axie is a global brand, so does the concept scale to the 2B underemployed adults of the world? I spent a lot of time over this last week talking to our local experts about this (thanks Shanks, Kookoo, Gabby, and Paul G!) and there’s a general consensus that Axie Infinity and its parent company SkyMavis still have some work to do to stabilize their in-game economy. There are some obvious gaps that even an outsider like me can spot a mile away, i.e., if creating teams is the only thing you can spend SLP on, there will eventually be too many teams earning daily SLP to support a good price. You can see that imbalance in the first 5 months of 2021, where the player earnings are vastly outpacing the breeding costs, but it looks like SkyMavis took some aggressive steps in June to rebalance the economy.

At the moment, the hype around Axie is pumping the prices of both $SLP and $AXS so much that it’s difficult to divine the true sustainability of the ecosystem. Eventually though they’ll hit their first big population milestone (5M? 10?) and really challenge the efficacy of the model at scale. Locally, our very own YGG is betting that this whole concept is going to be a real game-changer (pun very much intended) and their startup has received global recognition as a result of this bet. https://yieldguild.medium.com/

There have been many essays written on the socio-economic advantages of a Filipino being able to earn an income that doesn’t require migration, so I won’t spend time on that here. But I will say something about BloomX. When we started this company back in 2015, our goal was to make remittances cheaper by using cryptocurrency. I see now that the better goal was to make remittances unnecessary, and based on these early numbers it’s looking like there may be a way to do that that we’d never thought possible until this year.

See you all on Monday, cryptofam, and have a great weekend ❤

Wow, bloomx was founded in 2015. The dedication!

mind officially blown... 🤯🤯🤯