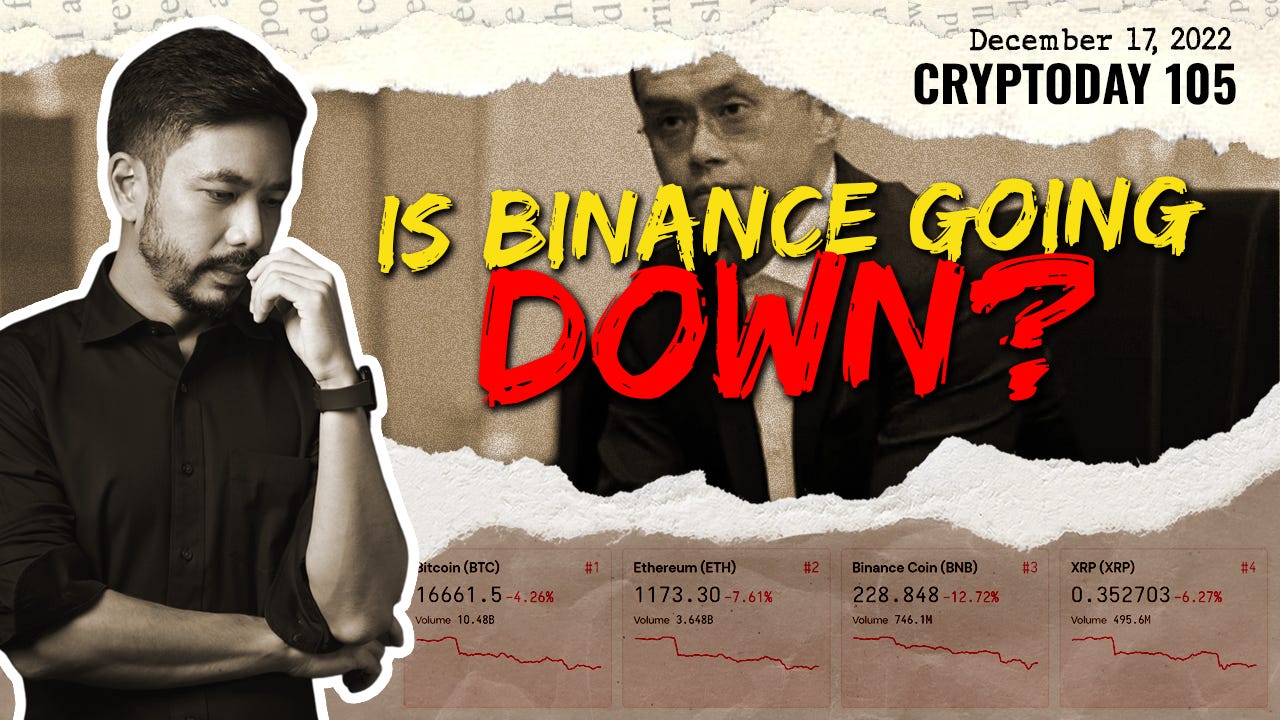

Is Binance Going Down?

CRYPTODAY 105

On Monday Dec 12th, SBF was arrested in the Bahamas following a marathon series of TV and podcast interviews in which he tried to present himself as an incompetent leader who had no idea what was happening inside his own company. His appeal for bail was promptly denied; he would instead sit in a Bahamanian jail cell for the next two months while awaiting his extradition hearing scheduled for February 8th in the new year. There’s been some speculation that Caroline Ellison, SBF’s ex-girlfriend and CEO of Alameda Research may have snitched on him, as she was spotted in NYC just one week before the Southern District of New York filed against him. Only after he is extradited to the US will the actual trial begin. Basically, that means we won’t be hearing much about SBF until next year, although it’s been reported that his parents have tried to request vegan meals for him in prison. Indeed it seems that the media has already switched its focus back to the player that supposedly kicked off FTX’s downfall: Binance.

The primary issue that the media appears to be latching on to is that FTX paid Binance $2B back in July 2021. Why? Because Binance was an early investor in FTX. As direct competitors, SBF no longer wanted CZ as a shareholder, so he did what every curly-haired billionaire would do: he decided to buy back all of the shares that Binance owned. That $2B payment was made using a combination of $BUSD, $BNB, and $FTT, and explains how CZ ended up with so much $FTT under his direct control. SBF had handed him the very weapon that Binance could use against them, as it was arguably CZ’s announcement that they would be liquidating all of their $FTT that accelerated FTX’s demise in early November.

In a recent CNBC interview, CZ was confronted with the question of whether Binance had the ability to return the $2B if the bankruptcy proceedings demanded it. Under US law, any transactions made up to 2 years prior to a bankruptcy will need to be inspected. If it’s eventually proven that the funds used to pay Binance were stolen or illegitimate in some way, that payment could be reversed, so there is a chance that Binance could be forced to return the funds.

CZ responded to the $2B question by saying that Binance was “financially OK.” It was not the greatest response ever, and he added that they would let the lawyers “handle it,” which made it sound even weaker. Now, that particular clip began circulating on Twitter without the most important part: the fact that he was responding to a question about the FTX buyback. Instead, people interpreted it as CZ dodging a general question about whether or not Binance could handle $2B in withdrawals. Unfortunately, we’re living in a post-FTX world now. The first sign of weakness in any exchange is their ability to process customer withdrawals, so any answer from CZ that wasn’t a resounding “yes” would cause an uproar. (I’m not sure why he was being so coy in this instance. He could’ve reminded the CNBC interviewer, for instance, that Binance’s revenues in 2021 were in the range of $20B.)

It also didn’t help that Binance reportedly had issues with USDC withdrawals on the day leading up to that interview. CZ clarified this was due to a delay caused by the timezone of the custodian bank in NYC, and not because they didn’t have the funds to cover the withdrawals. For what it’s worth, I fully accept this reason, as it’s a frequent challenge for crypto trading desks or exchanges alike, no matter how big or small you are. Crypto trades 24/7, but banks are only open about 30% of the time on any given week. Temporary liquidity crunches sometimes happen during busy days because you can’t perfectly forecast how many dollars you’ll actually need at any given time. What’s important to note here is that it’s always temporary, and usually gets fixed by the next banking day. (Which it did, in Binance’s case.)

But of course, the fearmongers went nuts. $BNB is currently down over 12%. I received quite a few private messages advising me to pull my funds out of Binance ASAP because it was going down. Now, I happen to understand this fear better than most. I actually lost funds in the FTX/Blockfi collapse, and I certainly don’t want to lose any more of my money if I can help it. Most people will probably choose to err on the side of caution in this situation. Instead of bothering to confirm the rumors, they’ll just withdraw all their funds and wait it out. But panic is never a good mental state to be in when making financial decisions. The main question is, where would you even put it? CZ was supposedly misquoted a few days ago when he said that 99% of people who self-custody their funds “will end up losing it.” Although “99%” sounds like a made-up number, I actually agree with the idea that most people in crypto don’t have the technical ability to secure their own non-custodial wallets. Pulling your money out and then moving it to your Metamask is not a great long-term solution if you don’t know how to secure your holdings.

With this lack of public trust, crypto exchanges are between a rock and a hard place. There’s been a recent trend amongst big exchanges to publish a “proof of reserves,” which attempts to show customers that a given exchange has enough money to cover all of their deposits. (For the mathematically inclined, there’s also a great explanation of how to use Merkle sum trees for this purpose from Vitalik himself.) The problem of course is that these proofs don’t say anything about any debts or liabilities that an exchange has incurred, and so you still don’t have a full picture of their solvency. The only other solution is to use an external auditor who will then certify that an exchange is 100% solvent. But that’s also problematic because there aren’t any world-class auditors willing to take on big crypto companies; they literally don’t know how. Michael Burry, the famed trader from The Big Short, says that auditors would be “learning on the job” and therefore any audit of a crypto firm would be “essentially meaningless.” So if you can’t publish your own proof of reserves, and you also can’t work with a third-party to publish an audited report, then what options do you have left? Nobody really knows, but the final answer to this would go a long way towards rebuilding all the trust the industry has lost this year.

Have a great holiday, cryptofam!

This industry is so hilarious and crazy - webtoons would fit well with your narratives. One day they will make cartoons or horror movies about this lol :)