My Dog Ate My Newsletter

CRYPTODAY 070

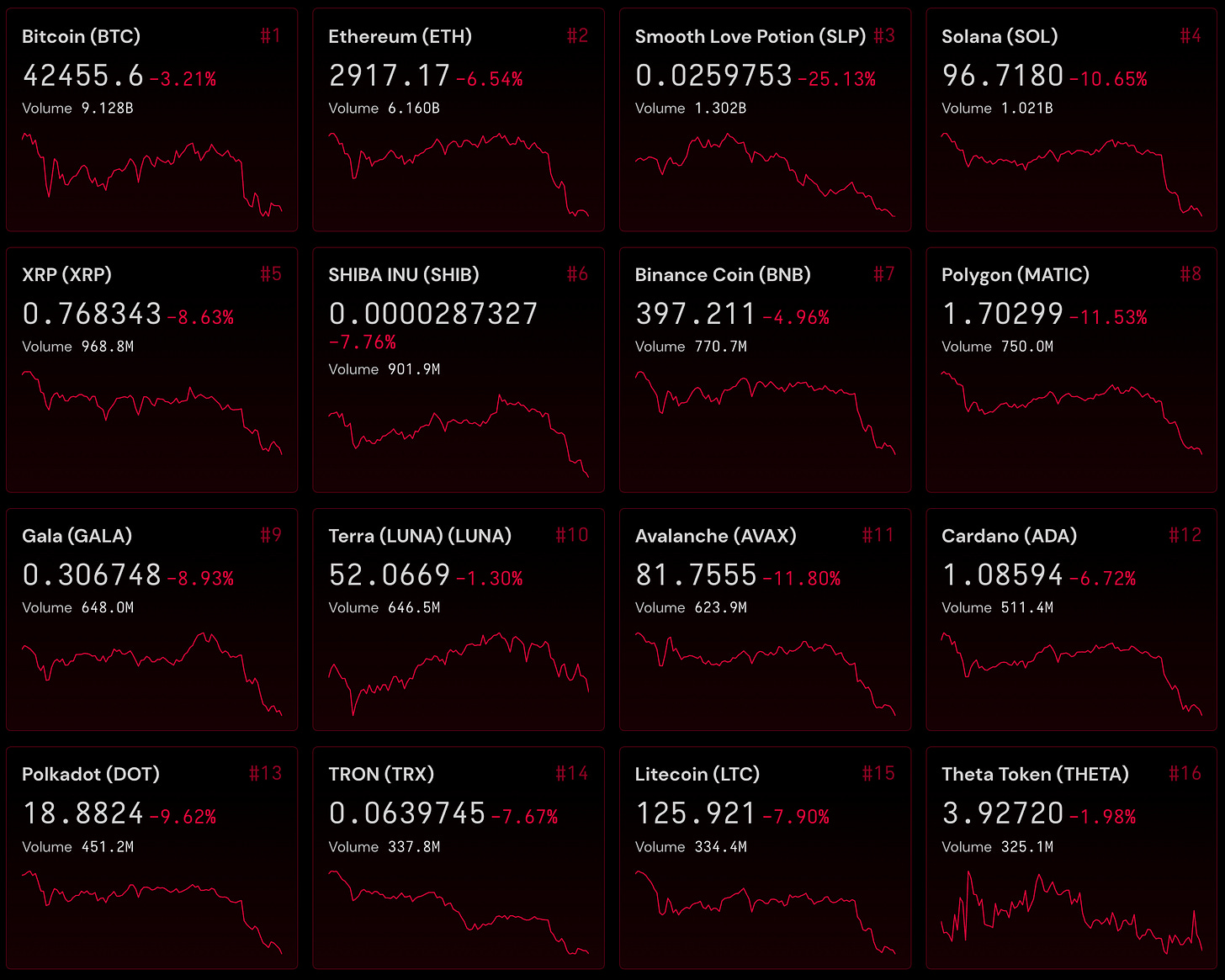

Welcome to the Saturday morning edition of Cryptoday! Hopefully, this new writing schedule will make it so that I can stop missing important crypto news dropping on Fridays. Case in point: after a strong green week for the markets, we had a sharp drop in the middle of the night Manila time. We are still in a far better position than the previous week however, with a total global market cap gain of about 10%.

SLP in particular went on an emotional rollercoaster ride, beginning with massively oversold conditions at less than $0.01 (PHP 0.50) and launching itself into the stratosphere at $0.04 (PHP 2.00) yesterday before coming back down to Earth in the wee hours at $0.025 (PHP 1.25). This week’s whiplash was brought to you, of course, by the recent announcements that SkyMavis was finally removing the rewards for the non-competitive side of Axie Infinity, which would reduce the issuance of SLP by 50%. In a retail market that was starved for buy signals, it was an obvious greenlight.

Some of the market has managed to hold on to its gains, with $BTC, $ETH, $BNB, and $ATOM all up by 10% from last week. Other coins swapped their green candles for reds, including $SOL (-4%) and $NEAR (-2%), while projects like $LINK, $FTM, and $LUNA all ended up right back where they started. Overall, the biggest gainers included $AVAX (+20%), $AXS (+21%), and $RON (+40%).

What’s behind this morning’s drop? Coindesk and Decrypt think it’s the increased tension between Russia and Ukraine, with US president Biden warning citizens to leave the latter country immediately. Additionally, US inflation reportedly hit its highest level since the 1980’s yesterday, which in theory would drive investor money to less risky assets (i.e., not stocks and cryptocurrencies).

In local news, PDAX announced that it had closed a massive $50M investment round on Thursday led by Tiger Global. The size of the round solidifies my theory that PDAX is gunning directly for the Philippine Stock Exchange’s business, and no longer wants to compete purely as a crypto exchange. This makes a lot of sense with Coins.ph recently re-entering the crypto scene after taking a 3-year detour into the mobile money wars, and Paymaya, Gcash, and Unionbank all heavily investing in their respective crypto exchange businesses. Hell, even Facebook has a crypto exchange license in the Philippines now. PDAX has a much higher chance of garnering mind share from the traditional stock trading communities than onboarding the play-to-earn crowd, especially given the extremely retail-oriented nature of the competition. Think about it: GCash and UB already host all of the Philippines’ play-to-earn users. The only thing missing is an exchange technology stack and that’s a trivial thing to integrate these days.

The Philippines is going to be a battleground for crypto on-ramps this year, with even international players like Coinbase, FTX, and of course, Binance angling for footholds. Generally speaking, this is going to be great for consumers, as all of these brands will be throwing substantial budgets into their marketing and growth efforts. It won’t be as great for any of the existing local crypto businesses, and I expect that we’ll see some consolidation later in the year as a result.

See you all next Saturday, cryptofam! Have a great weekend ❤️

Hello doggecoin!