Paymaya vs PDAX vs Coins.ph

CRYPTODAY 077

Back in May 2021, GCash announced that it was thinking of adding cryptocurrency exchange to its app, and I remarked that it felt like a fishing expedition to see how strong the public’s reaction would be. (Turns out that there was a ton of interest, at least based on the social media response.) It’s been nearly a year since then, and apart from a rather impotent press release in late March, there’s still no sign of the much anticipated “GCrypto” service. Now back in January, we first heard that PayMaya was making in-roads in the crypto world as well, when it (along with Facebook) officially received its Virtual Asset Service Provider license from the BSP. Turns out we were waiting on the wrong e-wallet giant.

I’ve been critical of PayMaya in the past — so much so that I was beginning to wonder if they were going to close my account — but I have to admit that I’m somewhat impressed that they launched their crypto exchange feature ahead of their biggest rival. They did so with the support of Coinbase Institutional, and this is yet another indicator of how the biggest brands in crypto are all positioning in the Philippines this year. The service is still pretty rough around the edges (there’s a prominent “beta” badge right above its icon in the PayMaya app), but it does currently represent the single most direct way for Filipinos to gain exposure to Bitcoin and other cryptocurrencies. Why? Because 38 million Filipinos already have the PayMaya app installed. In terms of potential reach, nothing else comes close. (Except of course, for their dilatory competitor GCash.) As with everything else though, there are several important caveats.

First, notice that I said “gain exposure to cryptocurrencies,” and not “use cryptocurrencies.” The PayMaya crypto trading feature allows you to buy and sell crypto, but it does not allow you to transfer it out. So the average PayMaya customer can buy 1,000 pesos worth of BTC for example, but they can only store it in the app. If the BTC price goes up, they can turn it back into pesos and realize some profit, but that’s it. They can’t take custody of their BTC themselves. A lot of you are probably wondering how useful this service is if you can’t actually withdraw the BTC that you buy, and my only response is: it’s still better than keeping all your money in pesos. Also, let’s not forget that when Paypal first launched its crypto trading feature in Oct 2020, it also didn’t allow deposits or withdrawals either, so there’s precedent for this approach.

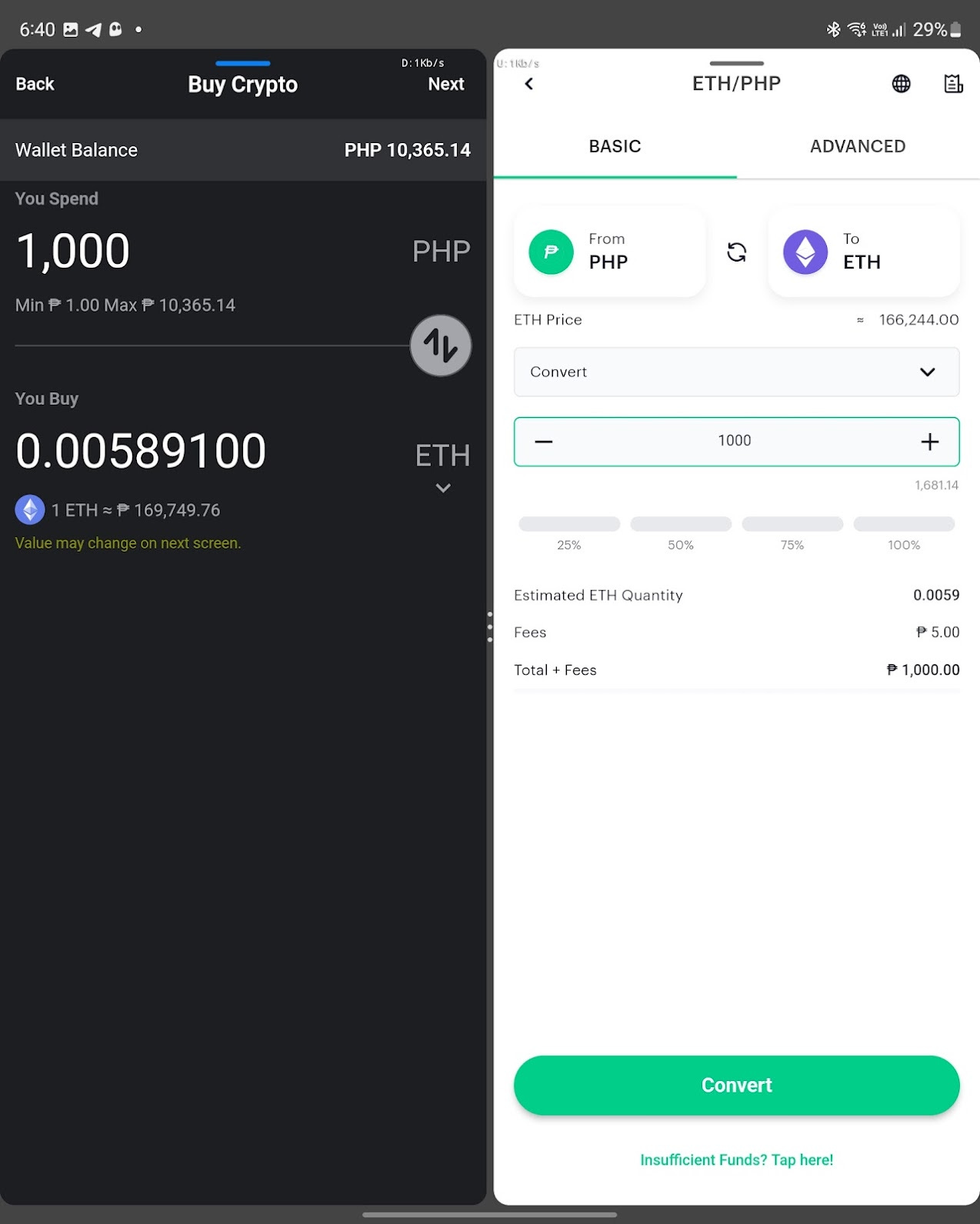

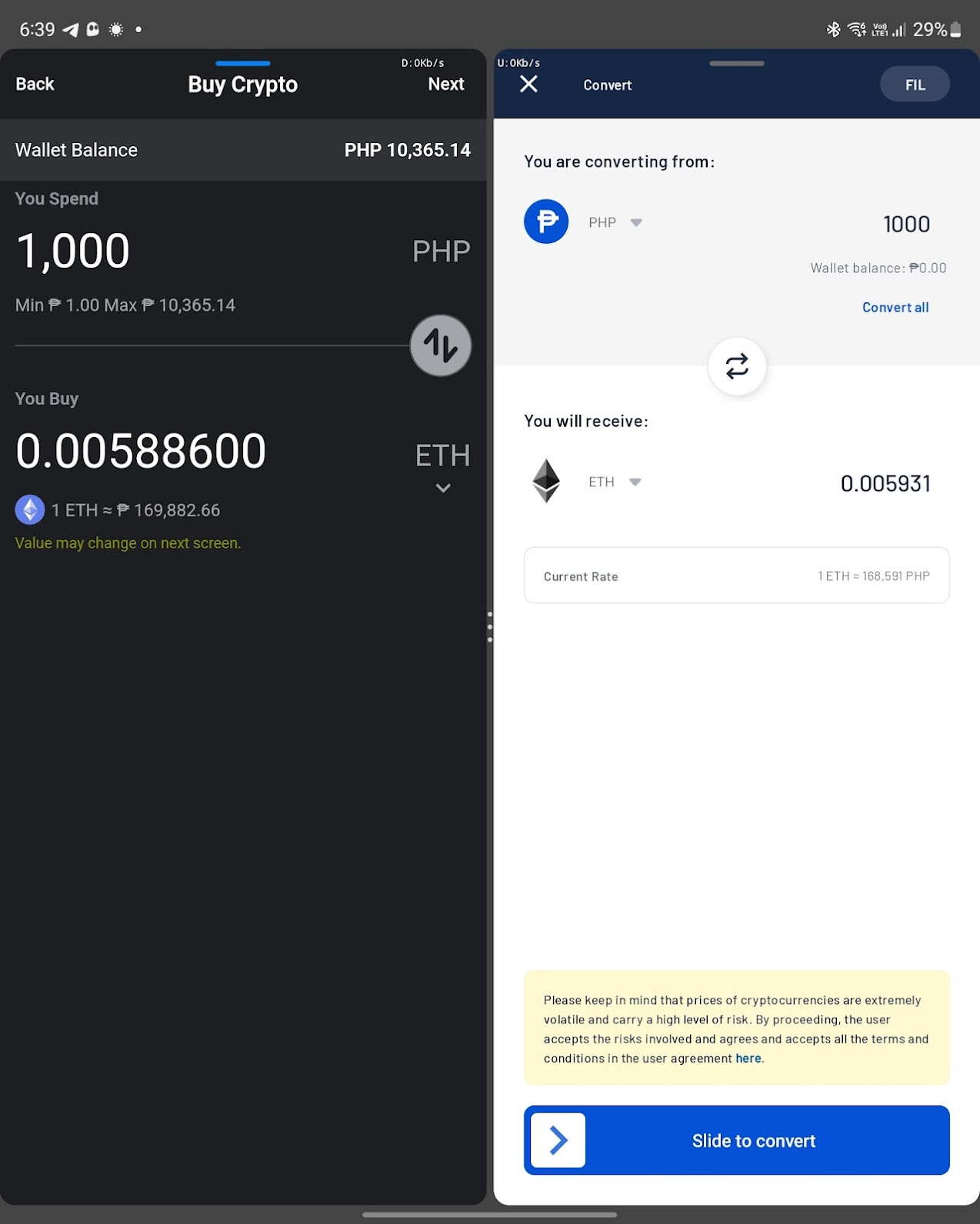

While doing research for this piece, I took a few screenshots comparing the PayMaya service with its primary competitors: PDAX and Coins.ph. If we’re looking at it purely from a market price standpoint, PayMaya is the most expensive of the three. When I did the comparisons this morning, PayMaya was charging around 2.5% for their ETH, Coins.ph was charging 2%, and PDAX was charging 0.5%.

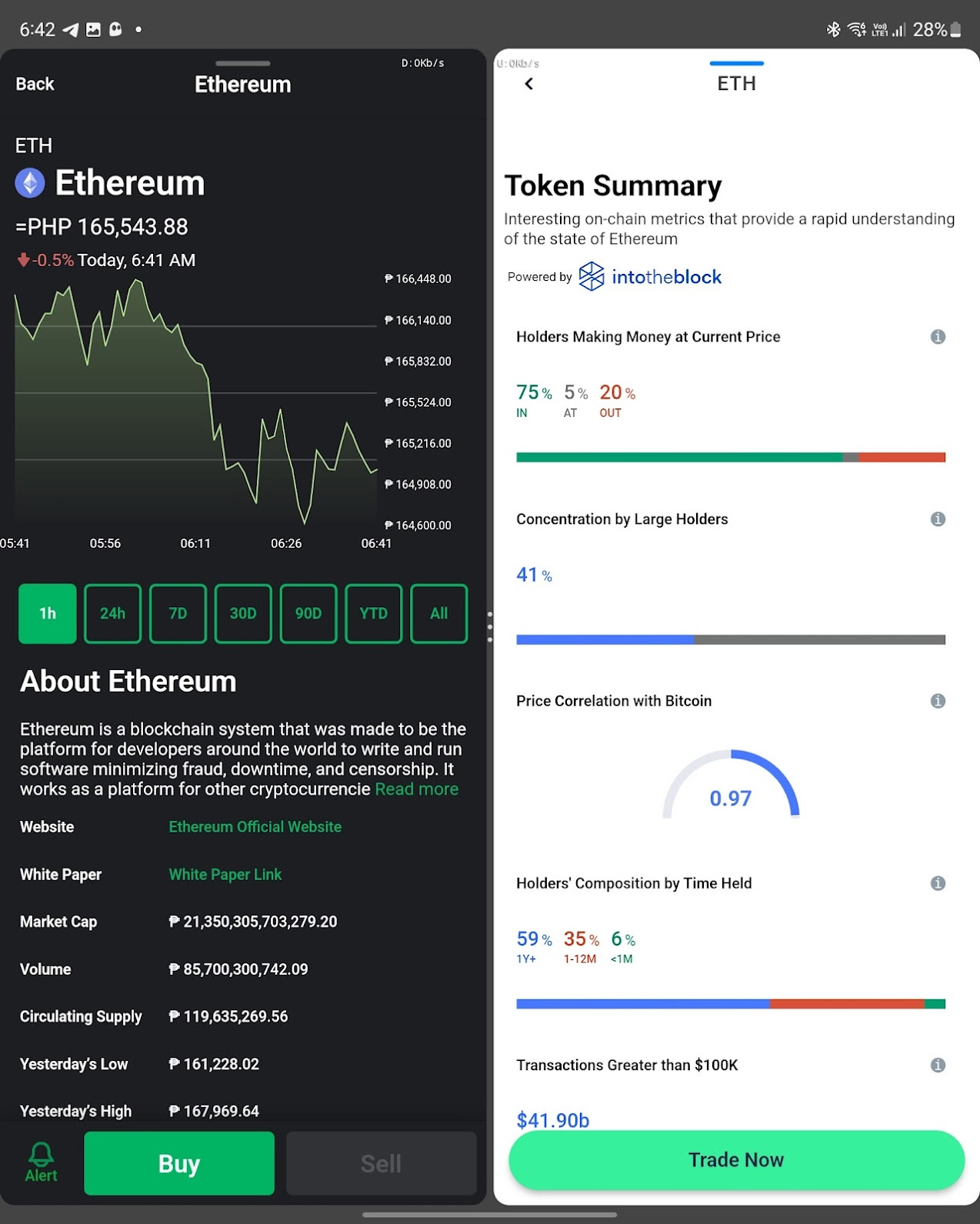

I should mention that PDAX is of course an orderbook exchange — i.e., you’re anonymously trading with multiple other users — so 0.5% is not the price you actually end up paying. That’s why they’re careful to say “Estimated ETH Quantity” when they describe how much ETH you will actually receive. They don’t actually know for sure until the order is executed. The PayMaya and Coins.ph prices are relatively high because they’ve abstracted the complexities of the orderbook and provide users with a guaranteed rate. In the trading world we call this an RFQ — request-for-quote system — and although it’s much easier for users to wrap their heads around, it is also typically more expensive. (Not *that* expensive though, 2.5% is a lot!)One thing I did appreciate about the PayMaya approach is the acknowledgment that, for 99% of their users, this will be the first time they’ve ever seen token symbols like “BTC,” “ETH,” or “QNT.” So I like that there are actual information pages about each coin, which includes links to external websites and even some recent news about them. (To anyone reading this from PDAX or Coins.ph, you can add these info sheets to your own respective pages in 2 minutes by subscribing to the CoinMarketCap API. Let’s just say I’ve done this before.)

Side note: QNT is an inexplicably random coin for them to support; there’s quite literally 74 more interesting coins ahead of it. I understand why they skipped XRP (legal issues) and BNB (Coinbase competitor), but Terra, Avalanche, Doge, and Near seem like far more relevant choices. In any case, I’ll be closely watching the PayMaya offering as it continues to evolve over the next several months. With Coinbase powering it, there should be a lot of opportunities to open it up not just to coins and tokens, but also eventually NFTs. Imagine buying all those expensive JPEGs directly with peso. I don’t know whether I’m shuddering from excitement or abject terror.

In other news, Coins.ph finally announced its new acquirer and its new CEO, ex-Binance CFO Wei Zhou. It’s interesting how Zhou is quoted as saying that he wanted Coins.ph to be “the crypto company when the world talks about the Philippines,” because for about 5 years, it already was. I’ve lost track of how many times people in international crypto conferences have found out that I’m from the Philippines and immediately asked if I worked for Coins.ph. Following the Gojek acquisition in 2019 however, the company became less of a crypto company, and more of a dark horse in the e-wallet race led by GCash and PayMaya. Three years hence and we now find those same three brands now jockeying for the lead position in a race that I am much, much more interested in. I have a feeling that PDAX with its $50M war chest is going to make things really crazy this time around, and there are still slots on the track for Binance, FTX, and that odd duck Facebook Novi group to join in as well. What an exciting time to be a crypto veteran in the PH!

See you all next Saturday, cryptofam!

Bullish for crypto in the Phil! 🚀🚀🚀