Twitter NFTs!

CRYPTODAY 014

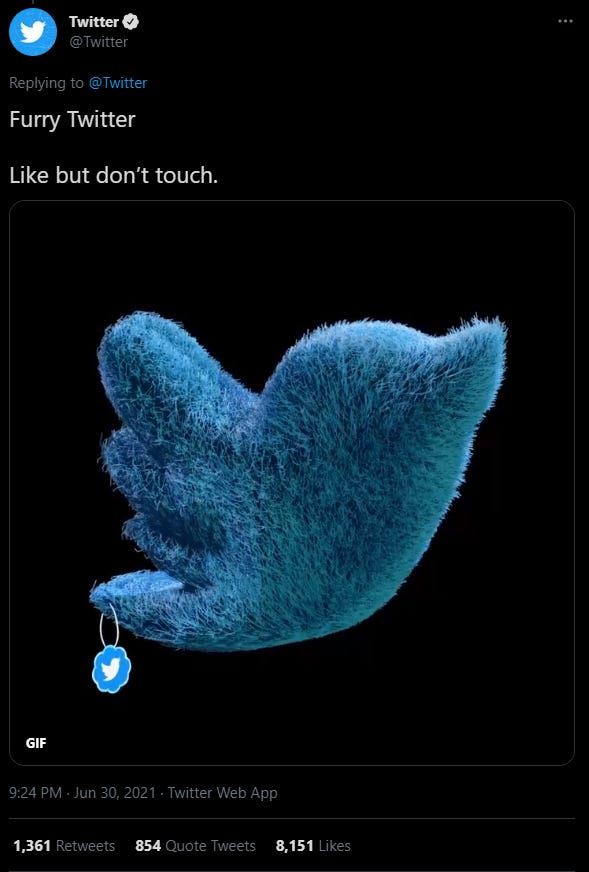

In a surprise move, Twitter dropped 140 NFTs earlier today to randomly-selected people on Twitter. It’s a slightly puzzling move from Twitter, given that their CEO is famously a Bitcoin maximalist. Jack Dorsey’s anti-ETH sentiments don’t appear to have stopped him from selling the first-ever tweet as an NFT, airdropping NFTart as they did earlier today, or launching official Twitter emojis for USDT and TRON last week.

The Twitter NFT campaign was executed in partnership with Rarible, an open marketplace that very recently closed a $14M Series A funding round. Because the NFTs were randomly distributed, the secondary market is insane. I spotted one that was successfully traded on OpenSea just hours later for 20 ETH (roughly 2M PHP).

You know what isn’t worth 2M PHP? Bitcoin. As we enter the third quarter of 2021, $BTC Q2 performance is now locked in at a fairly dismal -40%, during a period when it is traditionally quite bullish. This chart from Coindesk compares BTC’s Q2 performance from as far back as 2012, and 7 out of 10 times it was deep in the green. We are still +15% year-to-date though, so count your blessings. And if we’re only looking at $BTC’s June performance (-3%), it outdid most of the other big projects this month like $XRP, $LINK, and $EOS, which lost 30%.

I consider myself a well-adjusted crypto person but I find that I cannot stop writing about Internet Computer ($ICP) and its parent company Dfinity. Most people don’t remember these guys from the ICO days of 2017, but their pre-sale was priced at about $0.50. Numerous delays, including a fairly long crypto winter, prevented them from launching their token until just this May, and based on the reportage, it appears that only a handful of insiders were able to liquidate their investments. Once again, small retail investors were stuck holding the proverbial bag, while the big guys got to exit at 100x their buy-in (the ATH exceeded $700 on the opening days of trading). This lengthy Reddit thread alleges that Dfinity was intentionally deceptive, and is a fascinating read if you’re into trainwrecks.

Speaking of trainwrecks, the former lead developer of privacycoin Monero $XMR, Riccardo “fluffypony” Spagni recently destroyed a detractor on Twitter who was claiming that he could trace the details of any XMR transaction. Spagni sent a small XMR donation to the community’s general fund, and the detractor attempted to expose its inputs and outputs. Surprising no one, this was not possible. The resulting takedown made the engineer in me smile.

Robinhood, the popular retail trading platform that became a battleground during the Gamestop, Dogecoin, and WallStreetBets debacle earlier this year, is being ordered to pay a $70M fine by the Financial Industry Regulatory Authority. It’s the largest penalty FINRA has ever ordered and was levied due to excessive service disruption that resulted in “individual customers losing tens of thousands of dollars.” People following the Robinhood story in early 2021 will remember CEO Vladimir Tenev’s apology tour, wherein he attempted to placate the angry mob by blaming their clearing house and other externalities. Only $12.6M of the total $70M will actually be paid back to the affected customers, while the rest goes to the regulator. 😐

Stay safe out there, cryptofam!