What is Inflation?

CRYPTODAY 088

US inflation reportedly rose to 9.1% this last week, the highest it’s been in 40 years … and that’s a bad thing … right? For today’s newsletter, I wanted to talk about what inflation is, and how it affects the average Filipino as well as the average crypto investor. Now, whether you all are even aware of it, Axie Infinity players have been victims of inflation for a long time — they see its effects every day with SLP. As more SLP rewards are issued by the system, the overall value of each SLP goes down against the peso or the dollar — this is how we went from a 20-peso ATH in 2021 to the current value of 21 centavos. The unit value of each SLP has been severely diluted due to over-supply. (Incidentally, this is why Bitcoin makes such a big deal about its strict issuance schedule; BTC’s supply growth is set in stone, and it can’t inflate unexpectedly in the future.)

Now, it turns out that SLP and USD have a lot in common. A similar inflation has happened with the US dollar itself, because the US Federal Reserve has issued *a lot* of dollars in the last couple of years. During the pandemic, the money printers at the Fed were churning away day and night, and the end result was that the amount of total USD in circulation has quadrupled from around $5T to $20T. So now you’re probably wondering: “OK, but SLP can be converted to pesos or dollars, and that’s how we know that its value has dropped. But what do we use to measure the value of the peso or the dollar themselves?” Welcome to Economics 101. To start things off, let’s remember that money is really only good for one thing: buying stuff. Assuming you are earning money, you are probably doing so because you want to buy stuff with it at some point — today or in the future. So when we talk about concepts like inflation, what we’re really talking about is the ability of your money to hook you up with the stuff that you want.

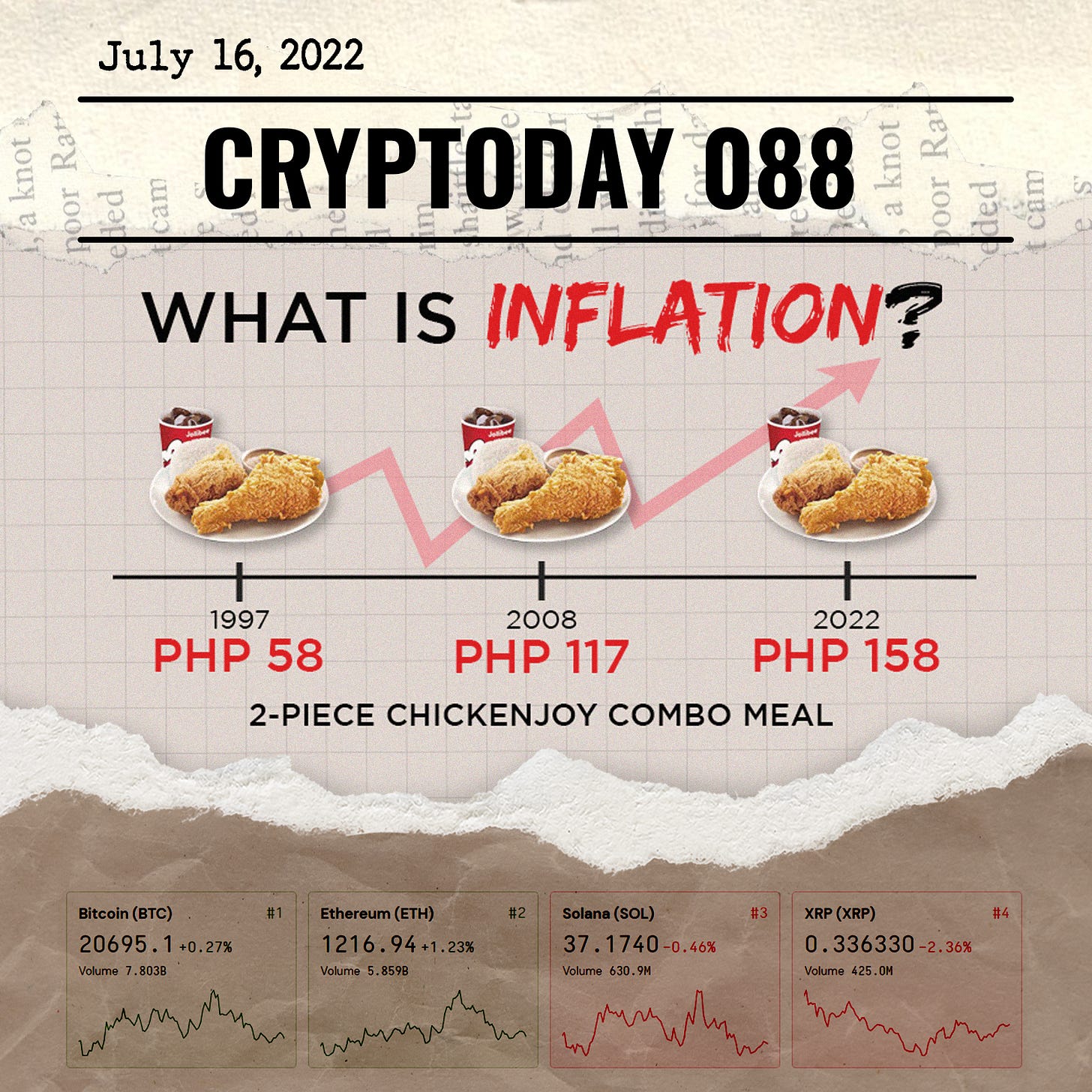

Here’s a simple way to visualize that idea: Back in 1997, a 2-piece Chickenjoy combo meal at Jollibee could be had for 58 pesos. In 2008, roughly a decade later, it was double that, at 117 pesos. Nowadays, it’s 50% higher, at 158 pesos. If you look at just the peso cost, it’s a shocking change, because we’re basically saying that Chickenjoy has 3x’d in price over the last two decades. But the reality is much more complex than that. You can’t just look at the cost of goods, you have to also compare it with how much people were earning back then. Again, the point of earning money is to allow people to buy stuff. The average minimum daily wage in 1997 was 180 pesos, in 2008 it was 380, and this year, it’s 570. So you can actually express the relationship of Chickenjoy-to-minimum-wage as roughly 30% of daily earnings. If we wanted a 2-piece Chickenjoy meal every day, we’d have to be willing to trade a third of our wages for it … which is a massive chunk. To complicate things further, we can assume that Jollibee itself was controlling the price of Chickenjoys because they want to maintain the quality of the meal, but make sure it’s still within occasional reach of the average Pinoy laborer.

Now, because Chickenjoy is not the only thing that matters to an economy, inflation is more formally measured by something called the Consumer Price Index (CPI). The CPI tracks not just Chickenjoy prices, but the average price of all the most popular goods and services that households spend on. In the US, the CPI is based on 94,000 prices of “stuff” — and this includes food, housing, healthcare, transportation, education, clothing, etc. CPI is calculated in much the same way here in the Philippines, and you can download the monthly reports produced by the Philippine Statistics Authority. So what the US Federal Reserve revealed in its recent inflation report was that over the last few months, the average price of stuff in the US had increased by 9.1% … which is essentially telling Americans that their money had lost nearly 10% of its buying power. Here in the Philippines, our own recent inflation rate report from the BSP revealed a 6% increase, meaning that we’re feeling a similar, although slightly smaller, money crunch.

As we saw in the hours following the Fed report, the crypto markets reacted by tanking like crazy. Bitcoin dropped below $20,000 again and Ethereum nearly touched $1,000. This is because traders know that high inflation rates means that the Federal Reserve will try to increase interest rates in response. “Raising interest rates” is one of the Fed’s primary tools for slowing down inflation … by essentially making it more expensive to borrow money. If we can’t borrow money, we are less likely to spend. In the Philippines, we’d feel this when we are thinking about buying a car or a condo, or even just an expensive new cellphone. The interest rates that the banks charge often have a big impact on whether we make the purchase or not. Think about how many times you’ve been enticed by BDO’s 0% interest installment payments when looking at tables for your new work-from-home setup. (The BSP’s new interest rate is set at 3.25%, which is the highest it’s been since the lockdown first started.) If customers are buying less stuff overall, businesses will be forced to keep prices low because otherwise, no one will buy all their Chickenjoys. And since inflation is all about the average price of stuff, we can say that raising interest rates has the effect of reducing inflation.

So how did all that impact the crypto market? Well, crypto is seen as a speculative investment by the majority of its holders. During a time of extreme inflation and high interest rates, people are more likely to just sell off their high-risk positions and go back to cash. It’s more conservative, and potentially also allows you to snipe cheap crypto at the bottom if you’re paying attention. The dip didn’t really last though, and Ethereum in particular has already come back to its $1,200 level. In this case, the bounce had nothing to do with inflation or interest rates. It was largely due to a recent announcement that Ethereum’s long-awaited Merge event now had a tentative launch date of Sept 19th. If you’ve forgotten what the Merge was, it’s the culmination of several years of engineering, which will result in Ethereum finally moving from the power-hungry proof-of-work algorithm to the more woke proof-of-stake. I’ll be writing more about this as we get closer to the date. There are a ton of economic and technological implications, not the least of which is that people will no longer be able to say that NFTs are bad for the environment :P

See you all next week, cryptofam! And please let me know if you found this informative. I’m trying to see if doing these fundamental explainers is useful for Cryptoday readers, or if you all prefer the usual news commentary.

As usual, very informative content again. Looking forward for the next, especially for the ETH merge thing :)

Getting the same for a much, much higher price. Awful… real wages will never ever be able to catch up. Keep foraging to survive.