What's Actually Going On with the AXS Price? (Investigating the Axie Phenomenon Part 4)

CRYPTODAY 020

This is the final part of my series on Axie Infinity, and if you’ve been following along since last week, we talked about (a) how Axie is starting to become the most popular crypto project in the Philippines (b) how the economic model of the game works (c) how I built a portfolio of Axie assets, and now finally I wanted to end the series with some macro observations and some warnings for newcomers.

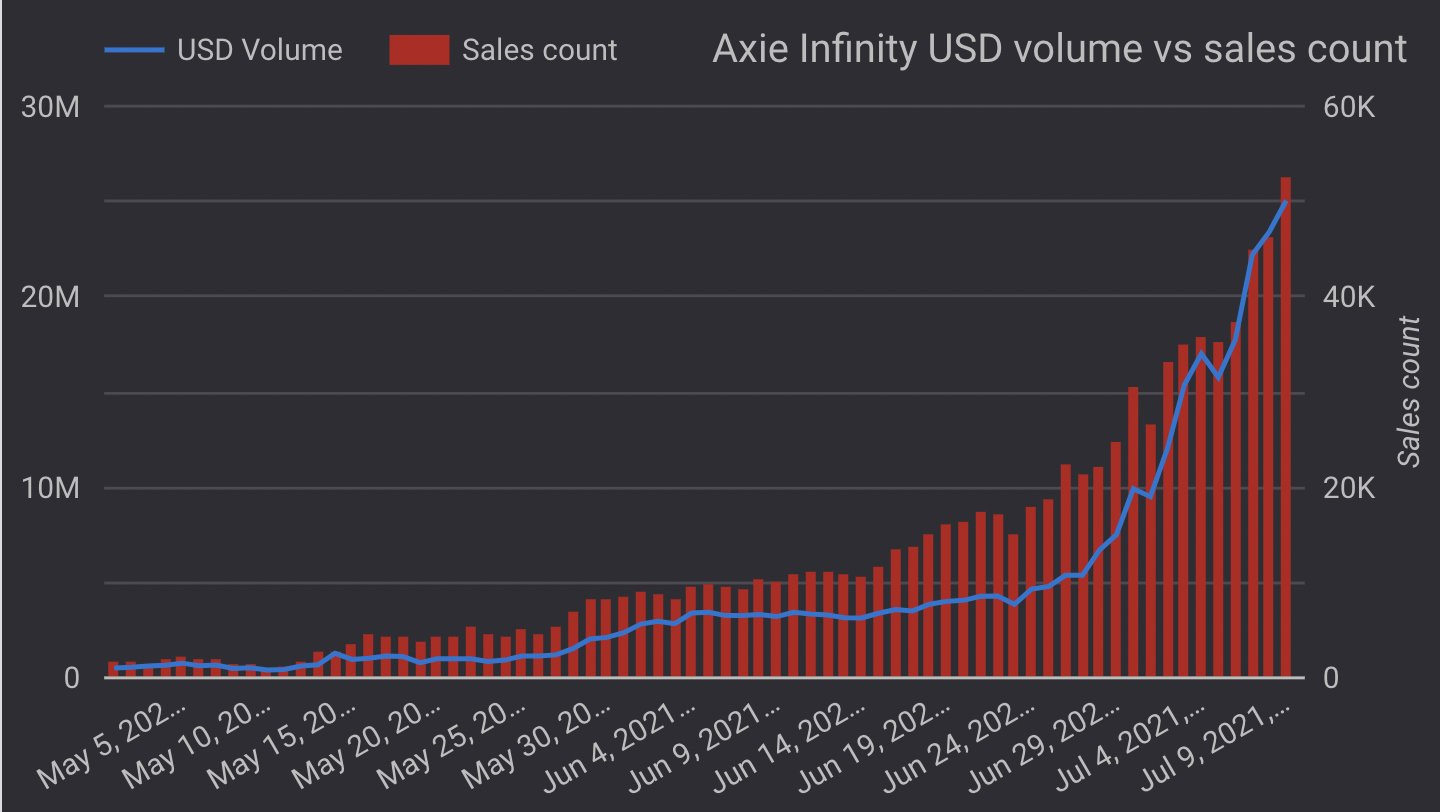

What actually triggered the $AXS and $SLP break-out this month? The easiest way to answer that one is to talk about manufacturing. The breeders are the manufacturing part of the ecosystem; they need both AXS and SLP in order to breed new axies, and every new player must buy from them to get started. In late June, SkyMavis decided to double the AXS payment for breeding, making it more expensive to create new teams to sell. This of course caused the prices of axie teams to go up, and caused the total marketplace sales volume (in USD terms) to go up as well. With breeders spending more, players spending more, and the demand for AXS going up, it was the perfect recipe for a strong rally. The price registered the news immediately, and it’s been non-stop since then.

The average Pinoy raked in over 30,000 pesos in June, which was already an incredible amount when compared with our minimum wage. The July figures are looking like it’ll be at least double of that and of course those estimates created even more hype. Now, with the daily-active-user count exceeding 500,000 and a healthy marketplace facilitating about $25,000,000 in sales daily, the crowds are feverish with excitement. Indeed, the Axie website has been really struggling to keep up with all the new eyeballs, and was down multiple times this week as a result.

There’s some indication that this is a bubble formation, which always ends up in a pretty intense price correction down the road. Most people believe that the size of the Axie ecosystem is now strong enough to maintain an internal economic equilibrium between the breeders and the players, but let me quickly correct that notion: it IS NOT the axie community that is the biggest contributor to the AXS price.

If it’s not the people buying and selling axies that are making everything rise in price, then who is it? Unfortunately, it’s the trading community, most of whom probably don’t even know what “AXS” stands for. All they care about is “trading the charts.” Check out the AXS/USDT Perpetual Futures on Binance below. There’s over $2.5B in AXS traded there EVERY DAY this past week, a figure that’s 100x LARGER than the actual Axie marketplace sales figures for that period. What is actually happening here? Basically, people are making bets on the axie ecosystem without actually participating in the axie ecosystem. If it were just axie breeders and players contributing to the economy, we would be ok, but the speculators don’t contribute anything, they just try to move the price in the direction that suits them. Right now that direction is “up,” but they could just as easily crash the price when they take profits at the top. This component is critical to understanding what actually contributes to the AXS price on any given day.

One of the worst consequences of the Axie hype here in the Philippines is the fact that the peer-to-peer marketplaces are pricing $ETH at 5% greater than mid-market rates this week. Why ETH? Because the Axie marketplace denominates its prices in ETH, and you need to have some ETH to buy your first team.

Screenshot of the Binance P2P marketplace, taken on 15 July 10:43am. Actual midmarket price of ETH at the time was 100,000 PHP equivalent. As of this Friday morning, this price disparity was still quite wide in the P2P marketplace, which greatly increases the overall entrance cost for newcomers.

I’ve said this before but this is a very tricky time to try to get into Axie Infinity, and that is especially true because most of this new money is coming from people with zero experience in crypto. They can not imagine what a bad downturn actually looks like, because they’ve never seen it happen. Instead they make naive estimates like “even if the SLP price went down to 12 pesos, we’ll still make our money back in 4-5 months.” Please allow me to disabuse you of that delusion. This is crypto. When things crash here, they crash by 80%, not 30%.

Imagine spending 120,000 pesos on your axie team today, and expecting a 3 month return-on-investment from the player you’ve sponsored. If SLP crashes back to 4 pesos, your time horizon suddenly becomes 12 months instead of three. For some people that’s probably still workable, but with a maximum earnings of less than 20,000 pesos a month, the whole opportunity becomes a lot less attractive for a lot of investors. That kind of crash generates a lot of negative externalities also: people that will start calling it a “scam” or “ponzi”, and the mainstream media will declare that “Axie is dead” and warn everyone to get their money out ASAP. We know this because it happens every single time Bitcoin has a bad dump. It’s such a well-known phenomenon, in fact, that there’s a website called Bitcoin Obituaries that collects news clippings from each time the mainstream media has pronounced Bitcoin as dead. It has collected 423 obituaries over the past 11 years.

Perhaps you’re reading my doomsday scenario and thinking to yourself, “Luis is exaggerating the downside here to make a point. SLP can’t possibly go down to 4 pesos from its current 15 peso price.” Sadly, I’m not exaggerating here. The last time SLP was in the 4-peso range was just three weeks ago. This kind of apocalyptic price drop happens ALL THE TIME in the crypto world and is something you need to assume is going to happen at some point. And just to emphasize it one more time: the last time SLP dropped by greater than 60% was during the third week of May, literally just two months ago.

If you’re an Axie fan or an interested investor, and this essay feels overly-negative to you, please understand that I’m doing that on purpose. Not enough people paint a balanced picture of Axie Infinity and new participants who come in at this stage need to be emotionally prepared for its challenges. I want the whole play-to-earn phenomenon to succeed as much as anyone, and part of the way to do that is to look at it very critically, and highlight its weaknesses as well as its strengths. If you’ve read through this entire series and are still interested/brave/financially-capable enough to get in, then congratulations, you’ve crossed the first threshold. However, if this has changed your mind about it and made you decide to hold back, then that’s fine too. This is high-risk and you should never let fear-of-missing-out become the primary motivation for your investment.

Next week, I’m going back to my normal, general coverage of the crypto economy, but given that Axie is all over the news right now, I’ll probably still be commenting on it for awhile to come. See you all on Monday, cryptofam, and have a great weekend!

If you haven’t already, please subscribe to my newsletter at https://cryptoday.substack.com ❤

I am going back for another steak dinner before the crash. I want to have a full stomach when it happens!