Why I've Stopped Investing in Bitcoin

CRYPTODAY 034

Yesterday I was on a call with some industry folks where I ended up talking about my personal motivations for being in cryptocurrency. It was something I’d never articulated in public before and I thought I’d repeat it here. When I started working in Bitcoin back in 2014 I was obsessed with this amazing technology that was made up in equal parts of computer-science wizardry, decentralized community, and a novel way of thinking about economics and monetary policy. It felt very relevant to the Philippines, and I spent the next several years of my life trying to make this rather complex technology accessible to the average Pinoy. It’s now been seven and a half years, and I’ve come to some interesting conclusions.

I continue to believe that Bitcoin is the best wealth storage technology that humanity has ever created, but here’s the problem with that statement: Most Filipinos don’t have any wealth to store. Even our most basic recommendation of buying 1,000 pesos worth of Bitcoin a month, just as a passive hedge against inflation, doesn’t really work here. For about 90% of Filipino households, that’s tantamount to asking them not to eat for one day each month. Bitcoin and cryptocurrencies don’t actually generate wealth unless you’re (a) extremely lucky with your timing or (b) you’re wealthy enough to freeze an investment for four years. Now (a) has happened enough times to enough people that we know that it’s not impossible. And if you’re part of the lucky 10% of the population that is fine with (b), then by all means, continue.

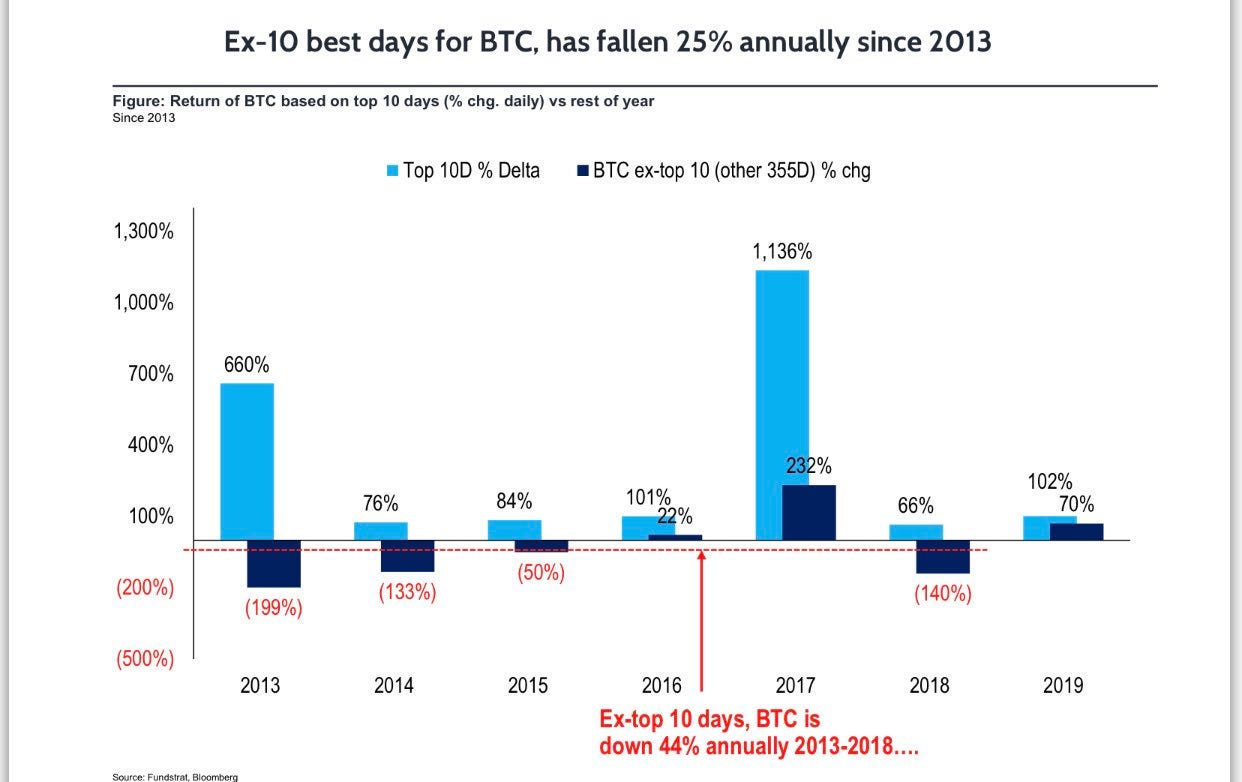

Let’s talk about that timing issue some more. Everyone knows that timing is incredibly important in crypto investments, but they often don’t know how heavily the odds are stacked against them. Based on the past eight years of market data, Bitcoin only makes substantial gains ten days out of a given year.

They called this the “rule of 10 best days,” but it’s not really a rule. It’s more of an observation that appears to be true most of the time. What it means is this: although it may seem like Bitcoin is constantly volatile, there’s actually only 10 days every year where the volatility is big enough (10% or more) to make a noticeable dent in your net worth. The problem of course is that you don’t know when precisely those 10 days are, and your odds of getting it right are 1 out of 36. So instead, Bitcoin investors just hodl, and pray that the crypto winter thaws out faster this cycle.

Where am I going with this? I’ve always focused on making crypto more accessible to Filipinos, but after all these years, I’ve come to realize that offering them Bitcoin as a “wealth storage” facility is not enough. Instead of teaching Pinoys how to store wealth, I think I’d like to focus on helping Pinoys generate wealth with crypto. My personal definition of “generating wealth” does not include buying a token and then waiting for its price to go up. Like I said above, it’s totally possible to do that, but it’s just perpetuating the myth that crypto investment is easy money, or worse, gambling. What are some of those ways? For people with some capital, Yield Farming has proven to be an active way to generate wealth. And then of course, Play-to-Earn is rethinking what it means to own and lend digital assets. Heck, even NFTart has probably generated more individual wealth for Filipino artists and collectors than Bitcoin ever has.

I know that this sounds like I’m hating on Bitcoin, but what I’m really doing here is describing a change in my personal outlook. I want to try teaching active wealth generation, rather than passive wealth storage, and you’ll be seeing more of that from Cryptoday from now on. I know I’ve probably annoyed a few people by writing this, but thankfully, you all don’t pay me for the newsletter ;) To my maximalist friends — all six of you — please know that I am in no way disregarding all of Bitcoin’s technological, economic, and cultural achievements. I’m merely refocusing on what I believe will be more useful to the average Filipino.

For the folks keeping tabs on my Axie journey, I momentarily broke into the 1600 MMR range last night but dropped back to 1580 shortly thereafter. Win-rate was at 55% over 40 duels.

I admit that I was playing very sloppily, but I’m hoping I can focus more today and move up to the 15 SLP reward range. I did earn 246 SLP though, which I exchanged for 2,137 pesos on BloomX. So far, it’s been a great ride, and the meta is deep enough that I feel like I’m only seeing the tip of the iceberg right now. I’m seven days away from my first SLP claim, so by the 27th I should have enough personal data to talk about the process from start-to-finish.

Thanks for reading, cryptofam! See you all on Friday!

And please don’t forget that if you prefer to read Cryptoday as an email you can subscribe right here:

.

It's good teaching filipinos about active wealth generation thru crypto/ NFTs. By doing this they can now create income and add them to create passive wealth storage.

I think it is better to educate filipinos about wealth generation and wealth preservation. Because most of filipinos if they can generate wealth they don't know where to put there money so they spend all there income. Filipinos should have atleast multiple source of passive income.

By the way I am your avid fan reader of your article. I don't miss 1 of your article that you post.

Yes the people need to GENERATE WEALTH… I remember the slogan before: “bawat sentimo para kinabukasan mo “ ang sabi ng mga bangko. Truth is yung sentimo mo magiging piso PARA sa bangko!!! parang MLM, yung kumikita yung na una, yung sumali, uto uto! Bwahahahaha! … Sige WEALTH GENERATION NA TAYONG LAHAT!!!