The Aftermath of the Crypto Ponzi

CRYPTODAY 119

Last week’s newsletter reached over a hundred thousand people, and although the reactions were largely positive, you can’t really blow a whistle without bad people hearing it as well. From May 12th to 14th, my posts were bombarded with virulent comments ranging from childish name-calling to accusations that I don’t know anything about crypto. I have to say I was a little shocked by how passionately people were defending a project that they clearly didn’t understand, but really this was a micro example of crypto’s biggest weakness. In crypto, people’s beliefs are backstopped by their wallets, so when you challenge those beliefs, they react like you are directly taking away their money. I was never going to convince the believers that they had just invested in a scam, so I just let it go. But then more recently, the scammers themselves decided to help make my case for me.

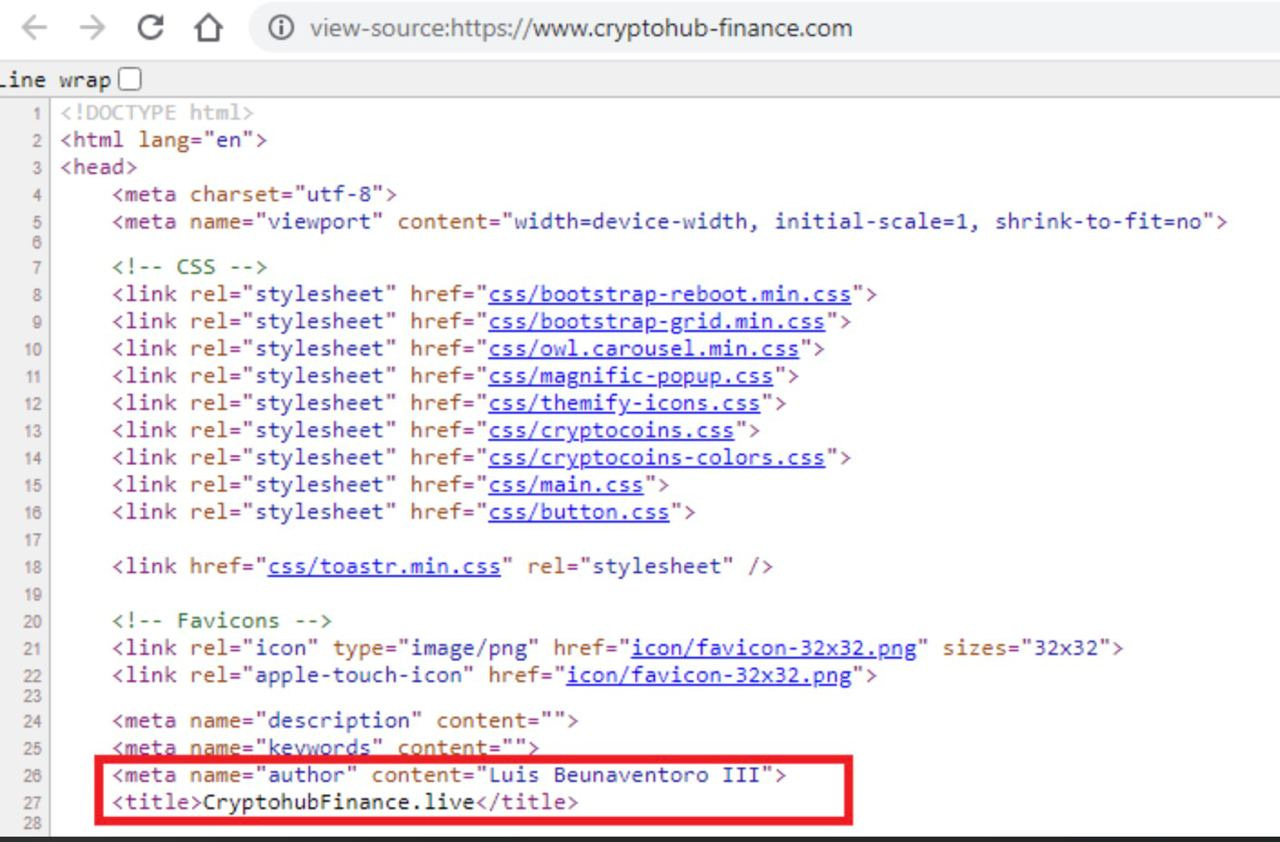

On May 16th, the creators of CryptoHub-Finance moved over $20,000 out of their main HubToken contract address and transferred those funds to their own wallet. This represented about 1/3 of all the money that CHF had raised from the public, leaving approximately $42,000 in the contract. I posted about this mysterious transaction on Facebook without further comment, because if we were to assume that they are a legitimate enterprise, there could be several reasons why such a transaction was necessary. On the other hand, an anonymous team that moves large amounts of project funds without informing its community is probably not a great indicator of things to come. But it gets better! Later that day, I found that the scammers had written a mangled version of my name into the metadata of their own website, making it look like I was the author of their page.

Then, on May 17th, they began redirecting their alternate website to YGG’s website. It looked like they were trying to set us up to be blamed when they inevitably pulled the rug out from under their investors. How anyone would ever think that YGG would be involved in something like this is beyond me.

The CHF team’s plan appears to have changed quite quickly, however. By the following day, their original website was no longer accessible, for reasons unknown. Meanwhile, their alternate website stopped redirecting to YGG and was relaunched with a whole new look. The smart contract on the blockchain, of course, can’t be taken down, and all of the transactions in and out of that address are plain as day. As far as I could tell it was still receiving investments from its most fervent believers, so I went into the contract’s on-chain transactions one more time to see how those investors were doing.

In total, the Cryptohub-Finance wallet has received over $65,000 in investments from 300 investors since it first went online on April 10th. From the list of investors, I picked two to look at more closely. One of them appears to be an influencer’s address (and I’ll explain shortly why I think so) and the other looks like an average solo investor. We’ll refer to them by the last three characters of their addresses, for brevity’s sake. You can follow along by downloading the on-chain transaction history directly as a CSV file from BSCScan and using Google Sheets filtering tools to understand the data. (I’m sure there are better tools out there for this kind of armchair blockchain forensics work, but I wasn’t feeling adventurous this morning as I was writing.)

The “influencer” investor, who we’ll call “2DC,” has so far received $785 in payouts from CHF. 2DC has been particularly active in investing in CHF, with their first investment of $3,510 occurring on April 26th. Since then, they’ve been topping up with small amounts — the smallest being $57 on April 29th and the largest being $205 on May 9th. In total, they’ve topped up 13 times. I believe this is an influencer who is allowing their followers to invest in CHF indirectly through them. 2DC and their followers have collectively invested $4,867 in CHF, and as I mentioned above, they have so far received $785 back.

The “solo” investor, who we’ll call “C11,” has so far received $18 in payouts from CHF. Now, unlike the influencer 2DC, C11 only made one investment in CHF on April 22 for $60. Whoever this person is, they are not a stranger to high-risk crypto investments though, as their transaction history is what we in the industry like to call a “shitcoin safari.”

Neither the influencer or the solo investor are anywhere near making their money back. They’re both about 75% underwater and with CHF’s web presence looking a little unstable this past week, I imagine their confidence level is not high. Nevertheless, they persevere. 2DC’s most recent top-up was literally yesterday for an additional $60. It’s good to remember that all of the money being paid out to 2DC, C11, and the other 300 investors are simply their own funds being redistributed.

Importantly, those 300 investors have also received allocations of the CHF HubToken, which is priced at ~$0.50 during this private sale. The idea here is to sell the token to these private-sale investors, and then everyone gets rich when the token gets listed on public exchanges after May 30th. But really this is all just investment theater because there’s nothing private about this sale, given that the investment forms are on a public website and they conduct no due diligence on their investors. Even if I believed that this was a legit project (which I don’t), CHF is $140,000 short of its goal, with less than a day left in their private sale. The idea that anyone would be interested in paying more than $0.50 for this on the open market seems far-fetched to me.

Keep safe out there cryptofam!

is it possible we get your real name not some fake ALL CAPS so we can Know Your Company as this works both ways. If you wish KYC but continue to scam by using fake alias names and handles, you only do yourself and the crypto community a disservice. Cease this activity, ban fake accounts with fake names or prepare for the consequences. Peace love and blessings…

Somehow, people judge their grocery budget closely (which is what, $300 at most?) but fail to do due diligence on "investing". Somehow "blockchain is transparent" gets conflated with "blockchain is safe".

Maybe tech as a background is too much of an unfair advantage for us?